Question: do all 3 C) job costing report D) equivalent units report 20) 20) During September, the Filtering Department of Olive Inc. had beginning transferred in

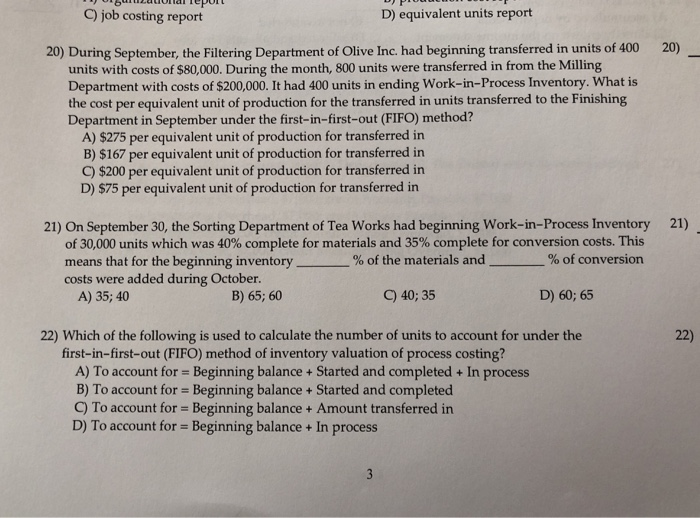

C) job costing report D) equivalent units report 20) 20) During September, the Filtering Department of Olive Inc. had beginning transferred in units of 400 units with costs of $80,000. During the month, 800 units were transferred in from the Milling Department with costs of $200,000. It had 400 units in ending Work-in-Process Inventory. What is the cost per equivalent unit of production for the transferred in units transferred to the Finishing Department in September under the first-in-first-out (FIFO) method? A) $275 per equivalent unit of production for transferred in B) $167 per equivalent unit of production for transferred in C) $200 per equivalent unit of production for transferred in D) $75 per equivalent unit of production for transferred in 21) On September 30, the Sorting Department of Tea Works had beginning Work-in-Process Inventory 21) of 30,000 units which was 40% complete for materials and 35% complete for conversion costs. This means that for the beginning inventory- -% of the materials and costs were added during October. % of conversion A) 35; 40 B) 65; 60 C) 40; 35 D) 60; 65 22) Which of the following is used to calculate the number of units to account for under the 22) first-in-first-out (FIFO) method of inventory valuation of process costing? A) To account for-Beginning balance+Started and completed + In process B) To account for Beginning balance+Started and completed C) To account for Beginning balance+ Amount transferred in D) To account for- Beginning balance+ In process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts