Question: do all ADJUSTING ENTRIES REQUIRED: Update the T-Accounts for the additional information below at 12/31/19, the end of the accounting year. Journal Entries are not

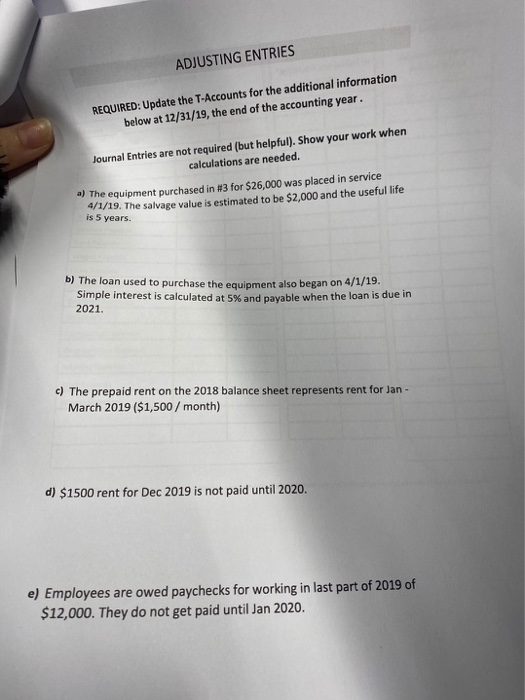

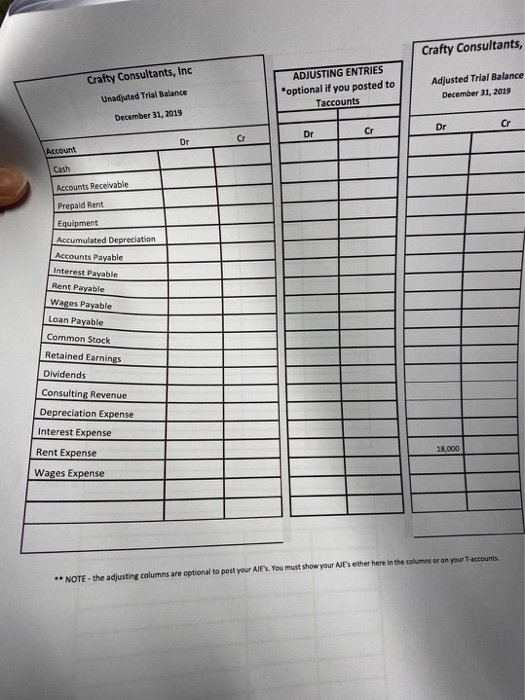

ADJUSTING ENTRIES REQUIRED: Update the T-Accounts for the additional information below at 12/31/19, the end of the accounting year. Journal Entries are not required (but helpful). Show your work when calculations are needed. a) The equipment purchased in #3 for $26,000 was placed in service 4/1/19. The salvage value is estimated to be $2,000 and the useful life is 5 years. b) The loan used to purchase the equipment also began on 4/1/19. Simple interest is calculated at 5% and payable when the loan is due in 2021. c) The prepaid rent on the 2018 balance sheet represents rent for Jan March 2019 ($1,500 / month) d) $1500 rent for Dec 2019 is not paid until 2020. e) Employees are owed paychecks for working in last part of 2019 of $12,000. They do not get paid until Jan 2020. Crafty Consultants, Crafty Consultants, Inc Unadjuted Trial Balance December 31, 2019 ADJUSTING ENTRIES *optional if you posted to Taccounts Adjusted Trial Balance December 31, 2019 Dr Cr Dr Cr Account Cash Accounts Receivable Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Interest Payable Rent Payable Wages Payable Loan Payable Common Stock Retained Earnings Dividends Consulting Revenue Depreciation Expense Interest Expense 18.000 Rent Expense Wages Expense ** NOTE - the adjusting columns are optional to post your AJES. You must show your Ale's either here in the columns or on your accounts. ADJUSTING ENTRIES REQUIRED: Update the T-Accounts for the additional information below at 12/31/19, the end of the accounting year. Journal Entries are not required (but helpful). Show your work when calculations are needed. a) The equipment purchased in #3 for $26,000 was placed in service 4/1/19. The salvage value is estimated to be $2,000 and the useful life is 5 years. b) The loan used to purchase the equipment also began on 4/1/19. Simple interest is calculated at 5% and payable when the loan is due in 2021. c) The prepaid rent on the 2018 balance sheet represents rent for Jan March 2019 ($1,500 / month) d) $1500 rent for Dec 2019 is not paid until 2020. e) Employees are owed paychecks for working in last part of 2019 of $12,000. They do not get paid until Jan 2020. Crafty Consultants, Crafty Consultants, Inc Unadjuted Trial Balance December 31, 2019 ADJUSTING ENTRIES *optional if you posted to Taccounts Adjusted Trial Balance December 31, 2019 Dr Cr Dr Cr Account Cash Accounts Receivable Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Interest Payable Rent Payable Wages Payable Loan Payable Common Stock Retained Earnings Dividends Consulting Revenue Depreciation Expense Interest Expense 18.000 Rent Expense Wages Expense ** NOTE - the adjusting columns are optional to post your AJES. You must show your Ale's either here in the columns or on your accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts