Question: Do all calculations using 9 decimal places, retain the 9 decimal places throughout the calculations, then when you report answers round to 2 decimal places.

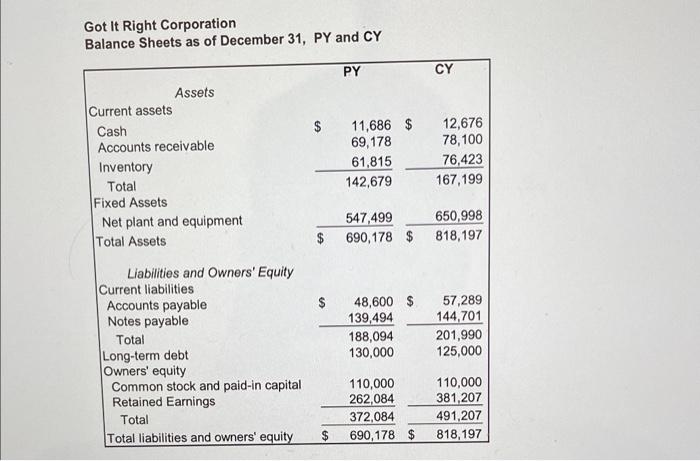

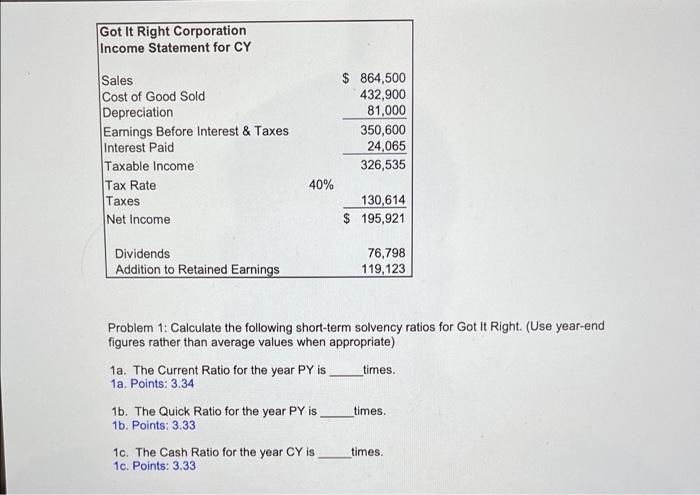

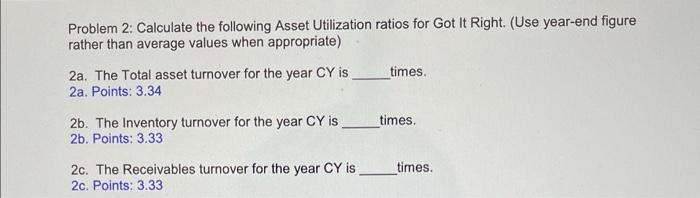

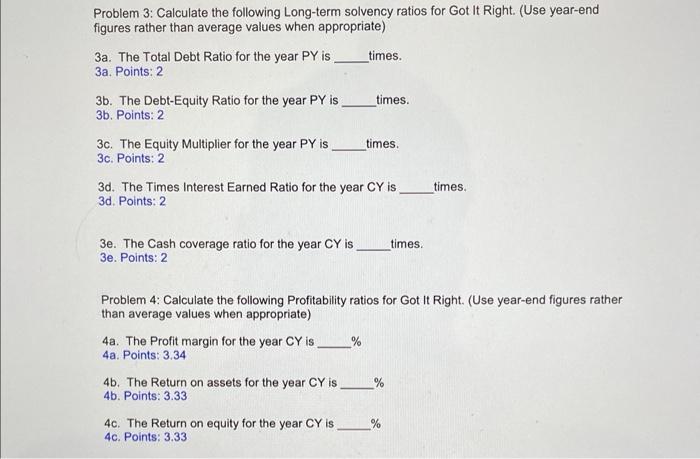

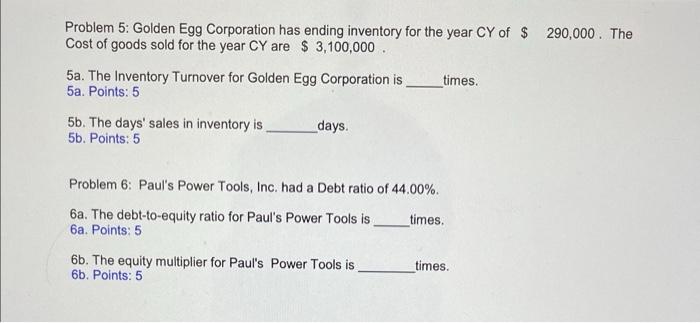

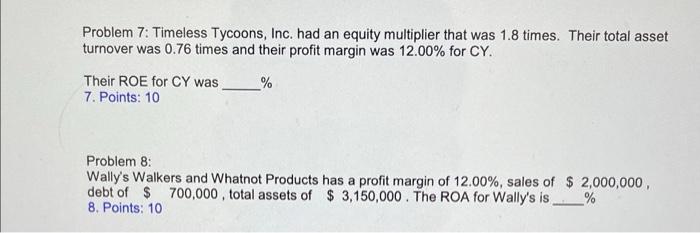

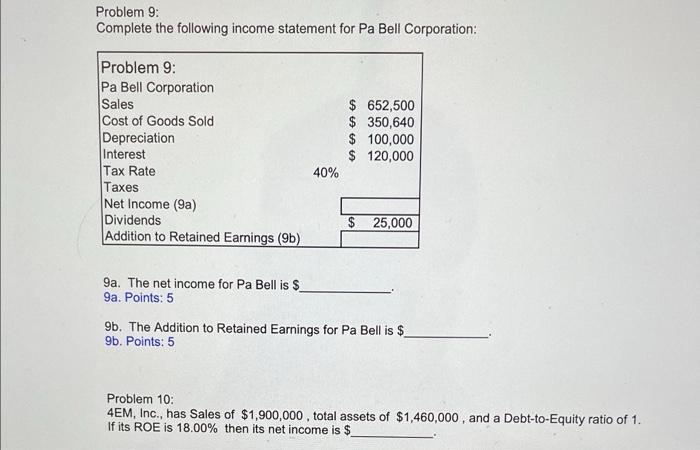

Do all calculations using 9 decimal places, retain the 9 decimal places throughout the calculations, then when you report answers round to 2 decimal places. Examples: If the answer is in years: i.e., 9.5576 report 9.56 years. If the answer is in dollars, i.e., $56.987.555 report to the nearest cent $56,987.56. If the answer is in percentage terms i.e., 10.4478% report 10.45% If the answer is in times i.e., 4.783 report 4.78 times. You need to be very precise with rounding and reporting. For instance, if the answer is 9 times you must report 9.00, the homework grading program will count 9 as incorrect, it would count 9.0 as incorrect, everything must be carried or rounded to two decimal places. Another example, if the answer is $48,000, you must report 48,000.00 Problems 14 use the following balance sheet and income statement data: Got It Right Corporation Balance Sheets as of December 31 , PY and CY Problem 1: Calculate the following short-term solvency ratios for Got it Right. (Use year-end figures rather than average values when appropriate) 1a. The Current Ratio for the year PY is times. 1a. Points: 3.34 1b. The Quick Ratio for the year PY is times. 1b. Points: 3.33 10. The Cash Ratio for the year CY is times. 1c. Points: 3.33 Problem 2: Calculate the following Asset Utilization ratios for Got It Right. (Use year-end figure rather than average values when appropriate) 2a. The Total asset turnover for the year CY is times. 2a. Points: 3.34 2b. The Inventory turnover for the year CY is times. 2b. Points: 3.33 2c. The Receivables turnover for the year CY is times. 2c. Points: 3.33 Problem 4: Calculate the following Profitability ratios for Got It Right. (Use year-end figures rather than average values when appropriate) 4a. The Profit margin for the year CY is % 4a. Points: 3.34 4b. The Return on assets for the year CY is % 4b. Points: 3.33 4c. The Return on equity for the year CY is % 4c. Points: 3.33 Problem 5: Golden Egg Corporation has ending inventory for the year CY of $290,000. The Cost of goods sold for the year CY are $3,100,000. 5a. The Inventory Turnover for Golden Egg Corporation is times. 5a. Points: 5 5 b. The days' sales in inventory is days. 5b. Points: 5 Problem 6: Paul's Power Tools, Inc. had a Debt ratio of 44.00%. 6a. The debt-to-equity ratio for Paul's Power Tools is times. 6a. Points: 5 6b. The equity multiplier for Paul's Power Tools is times. 6b. Points: 5 Problem 7: Timeless Tycoons, Inc. had an equity multiplier that was 1.8 times. Their total asset turnover was 0.76 times and their profit margin was 12.00% for CY. Their ROE for CY was % 7. Points: 10 Problem 8: Wally's Walkers and Whatnot Products has a profit margin of 12.00%, sales of $2,000,000, debt of $700,000, total assets of $3,150,000. The ROA for Wally's is 8. Points: 10 Problem 9: Complete the following income statement for Pa Bell Corporation: 9a. The net income for Pa Bell is S 9a. Points: 5 9b. The Addition to Retained Earnings for Pa Bell is $ 9b. Points: 5 Problem 10: 4EM, Inc., has Sales of $1,900,000, total assets of $1,460,000, and a Debt-to-Equity ratio of 1 . If its ROE is 18.00% then its net income is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts