Question: DO ALL! no explanation needed! assignment-takeinprogress=false Calculator According to the historical cost principle, assets are measured at the exchange price at the time the activity

DO ALL! no explanation needed!

DO ALL! no explanation needed!

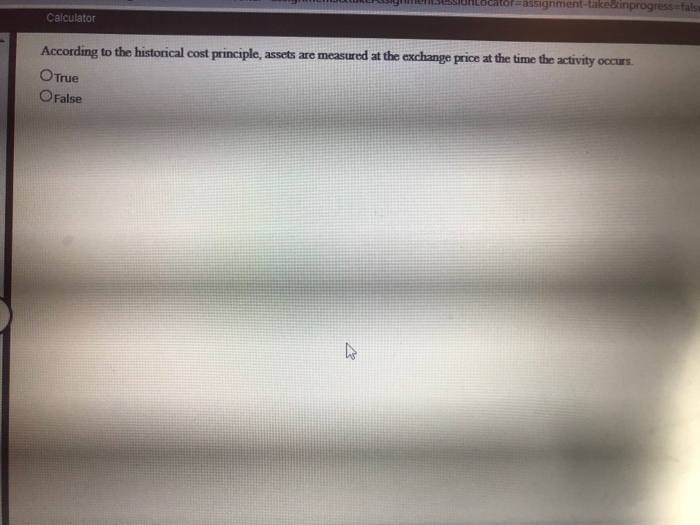

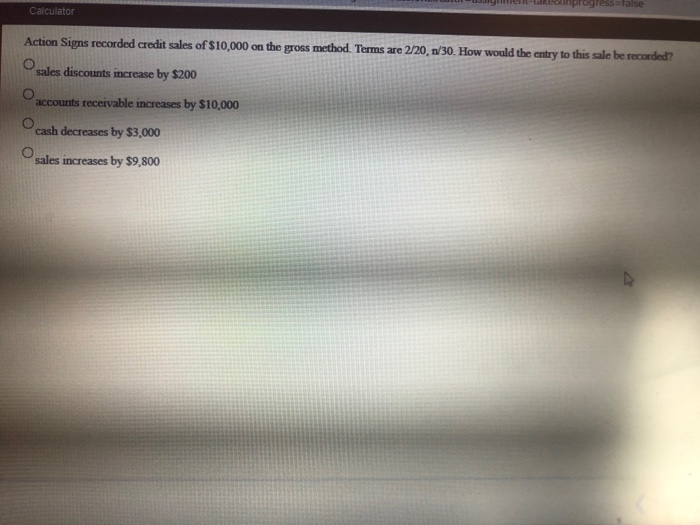

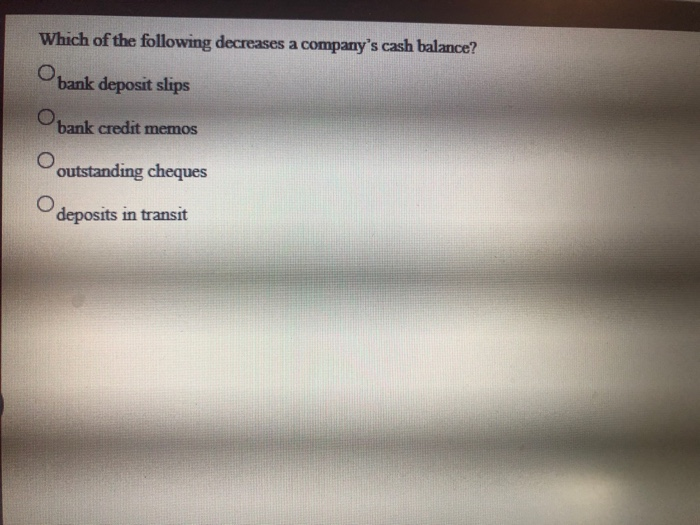

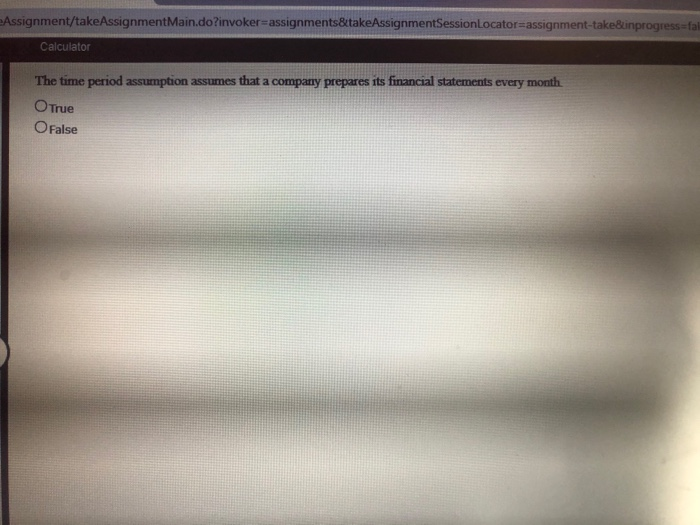

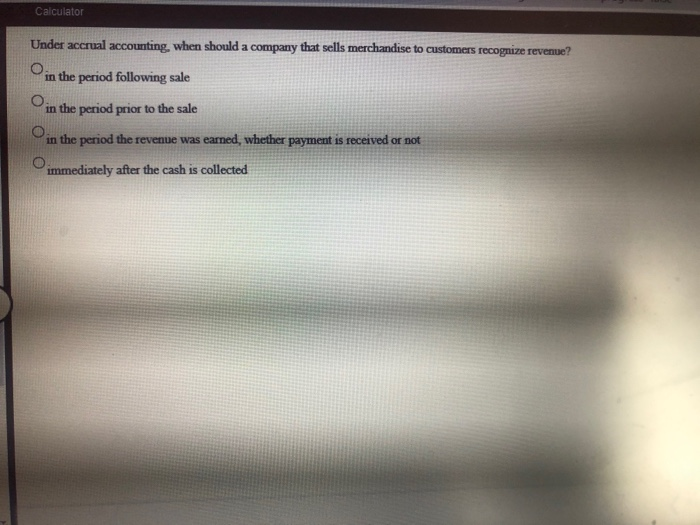

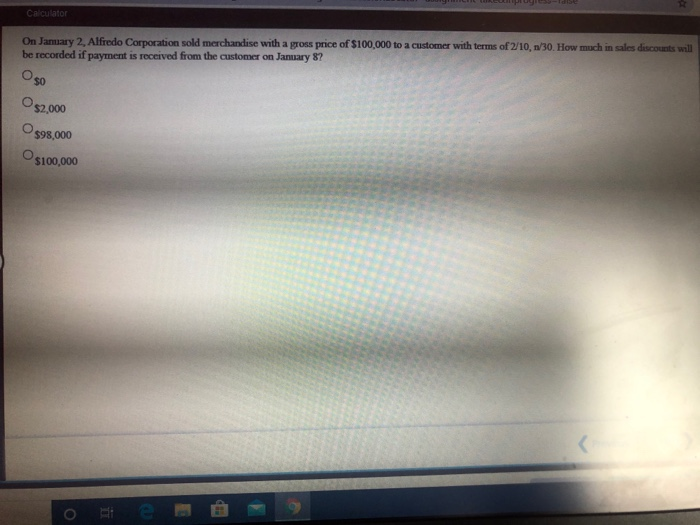

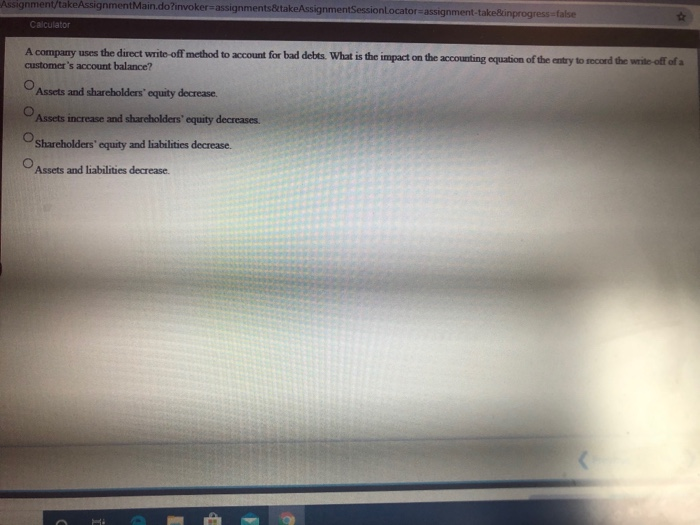

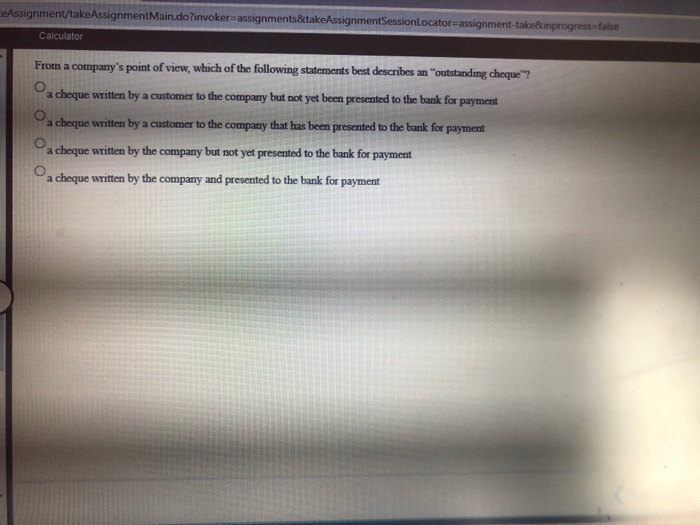

assignment-takeinprogress=false Calculator According to the historical cost principle, assets are measured at the exchange price at the time the activity occurs. O True O False Tess=false Calculator Action Signs recorded credit sales of $10,000 on the gross method. Terms are 2/20, 1/30. How would the entry to this sale be recorded? sales discounts increase by $200 accounts receivable increases by $10,000 cash decreases by $3,000 sales increases by $9,800 Which of the following decreases a company's cash balance? Obank deposit slips bank credit memos O outstanding cheques O deposits in transit Assignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator assignment-take&inprogress=fali Calculator The time period assumption assumes that a company prepares its financial statements every month O True O False Calculator Under accrual accounting, when should a company that sells merchandise to customers recognize revenue? in the period following sale O in the period prior to the sale in the period the revenue was earned, whether payment is received or not O immediately after the cash is collected Calculator On January 2, Alfredo Corporation sold merchandise with a gross price of $100,000 to a customer with terms of 2/10, 1/30. How much in sales discounts will be recorded if payment is received from the customer on January 8? O 50 $2,000 os O$100,000 $98.000 HD o Assignment/take AssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator assignment-take&inprogress=false Calculator A company uses the direct write off method to account for bad debts. What is the impact on the accounting equation of the entry to record the write off of a customer's account balance? Assets and shareholders' oquity decrease. O Assets increase and shareholders' equity decreases. Shareholders' equity and liabilities decrease. Assets and liabilities decrease. CeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogress=false Calculator From a company's point of view, which of the following statements best describes an "outstanding cheque"? a cheque written by a customer to the company but not yet been presented to the bank for payment oa a cheque written by a customer to the company that has been presented to the bank for payment a cheque written by the company but not yet presented to the bank for payment a cheque written by the company and presented to the bank for payment assignment-takeinprogress=false Calculator According to the historical cost principle, assets are measured at the exchange price at the time the activity occurs. O True O False Tess=false Calculator Action Signs recorded credit sales of $10,000 on the gross method. Terms are 2/20, 1/30. How would the entry to this sale be recorded? sales discounts increase by $200 accounts receivable increases by $10,000 cash decreases by $3,000 sales increases by $9,800 Which of the following decreases a company's cash balance? Obank deposit slips bank credit memos O outstanding cheques O deposits in transit Assignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator assignment-take&inprogress=fali Calculator The time period assumption assumes that a company prepares its financial statements every month O True O False Calculator Under accrual accounting, when should a company that sells merchandise to customers recognize revenue? in the period following sale O in the period prior to the sale in the period the revenue was earned, whether payment is received or not O immediately after the cash is collected Calculator On January 2, Alfredo Corporation sold merchandise with a gross price of $100,000 to a customer with terms of 2/10, 1/30. How much in sales discounts will be recorded if payment is received from the customer on January 8? O 50 $2,000 os O$100,000 $98.000 HD o Assignment/take AssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator assignment-take&inprogress=false Calculator A company uses the direct write off method to account for bad debts. What is the impact on the accounting equation of the entry to record the write off of a customer's account balance? Assets and shareholders' oquity decrease. O Assets increase and shareholders' equity decreases. Shareholders' equity and liabilities decrease. Assets and liabilities decrease. CeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inprogress=false Calculator From a company's point of view, which of the following statements best describes an "outstanding cheque"? a cheque written by a customer to the company but not yet been presented to the bank for payment oa a cheque written by a customer to the company that has been presented to the bank for payment a cheque written by the company but not yet presented to the bank for payment a cheque written by the company and presented to the bank for payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts