Question: do all the step. do as it done in the sinilar problem. please do all the steps. thsi is the question below is the example

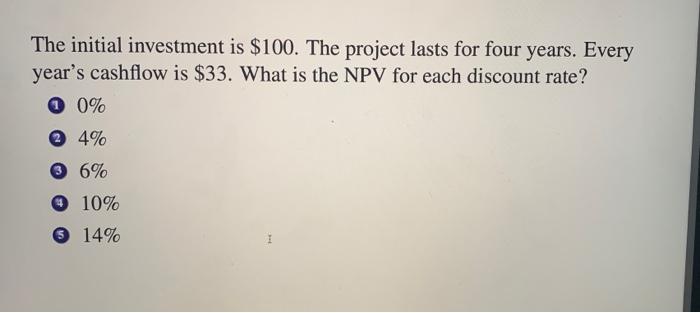

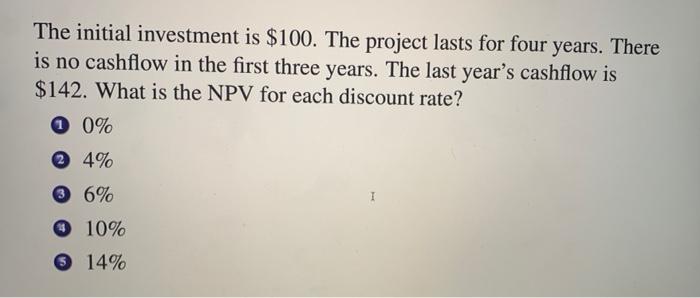

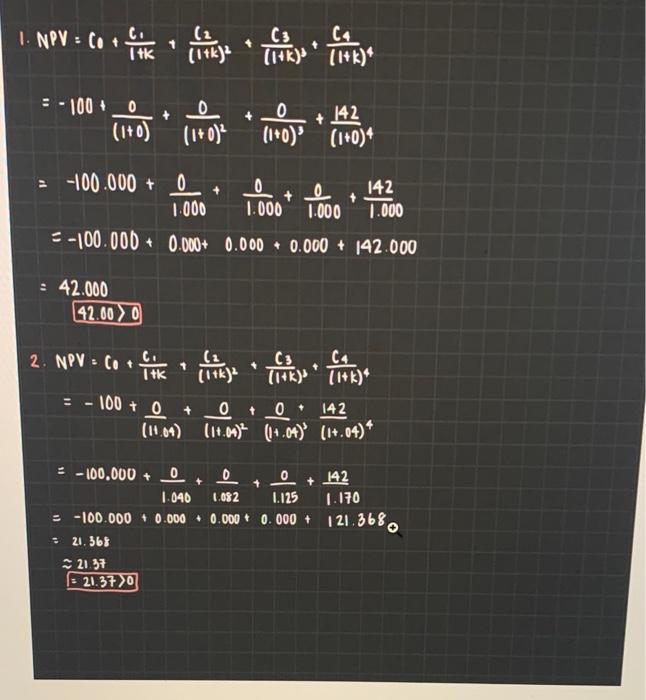

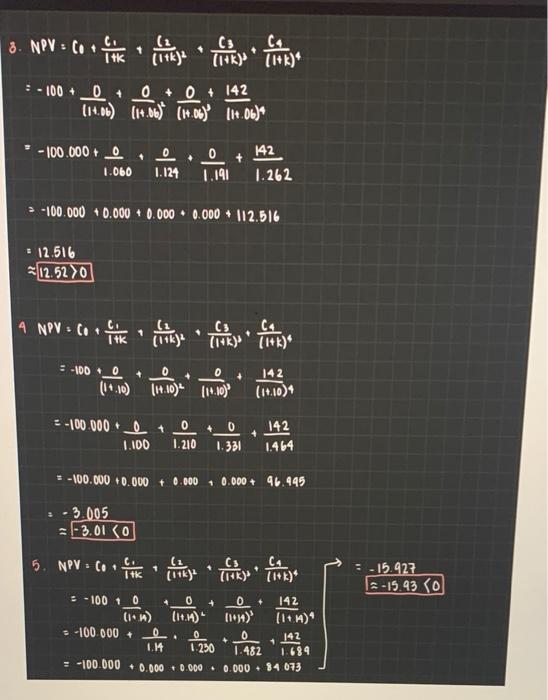

The initial investment is $100. The project lasts for four years. Every year's cashflow is $33. What is the NPV for each discount rate? 0% 4% 6% 10% 14% The initial investment is $100. The project lasts for four years. There is no cashflow in the first three years. The last year's cashflow is $142. What is the NPV for each discount rate? 0 0% @ 4% 3 6% I 10% 14% 1. NPV = 10 + ou like Telefone (1tk) C3 CA (14k)" (1+k)* 0 5-100_0 (1+0) O (1+0)' (1+0)4 + 142 (1+0) + + = -100.000 + 0 0 142 + 1.000 1.000 1.000 5-100.000+ 0.000+ 0.000 0.000 + 142.000 1.000 : 42.000 42.00 > 0 2. NPV - Co + 100+ 0 C (2 It (1+k) 14k) [1+k)* + 0 + 0 142 (11.04) (14.0m? (14.04) (14.04)* 0 + + + 1.170 = -100.000 + 0 . 142 1.040 1.082 1.125 = -100.000 0.000 0.000 0.000 + 121.368 21.368 21.37 - 21.370 3. NPN = Cof , (1tk) I-R) : -100+ 0 + 0 + 0 + 142 ( 14 ) 4. by [+[IA.Obj- * - 100.000 + 42 + + 6 1.124 1.060 0 1.191 1.262 > -100.000 0.000 0.000 0.000 112.516 12.516 12.520 4 NPN : ( [i It ,, (116) : -100+ 0 (14.10) 11:10) (14.10) + 142 (14.10) : -100.000 et 4 0 1.210 4 0 1.331 142 1.464 1.ADD = -100.000 0.000 0.000 10.000 + 46.445 3.005 -3.010 5. NPN :[et Li 1 = -15.427 E-15.93 ro 4 4 + .-100 1 0 6 6 142 (14.4) 11+3+) -100.000 e 1.14 1.250 1.482 1.684 = -100.000 0.000 0.000 0.000 34 073 142 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts