Question: do both please for a thumb up You work for a pharmaceutical company that has developed a new drug. The patent on the drug will

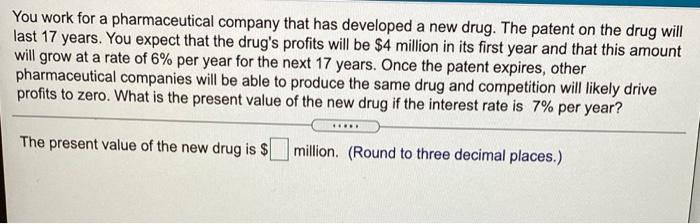

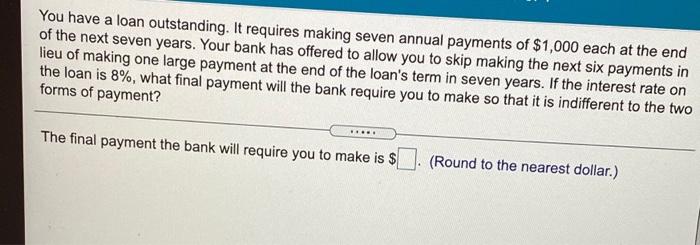

You work for a pharmaceutical company that has developed a new drug. The patent on the drug will last 17 years. You expect that the drug's profits will be $4 million in its first year and that this amount will grow at a rate of 6% per year for the next 17 years. Once the patent expires, other pharmaceutical companies will be able to produce the same drug and competition will likely drive profits to zero. What is the present value of the new drug if the interest rate is 7% per year? The present value of the new drug is $ million. (Round to three decimal places.) You have a loan outstanding. It requires making seven annual payments of $1,000 each at the end of the next seven years. Your bank has offered to allow you to skip making the next six payments in lieu of making one large payment at the end of the loan's term in seven years. If the interest rate on the loan is 8%, what final payment will the bank require you to make so that it is indifferent to the two forms of payment? .. The final payment the bank will require you to make is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts