Question: Do exercise four 2 Page 136 5 marks Subject: Calculation of Tax Payable before Credits During 2011, Joan Matel is a resident of Ontario and

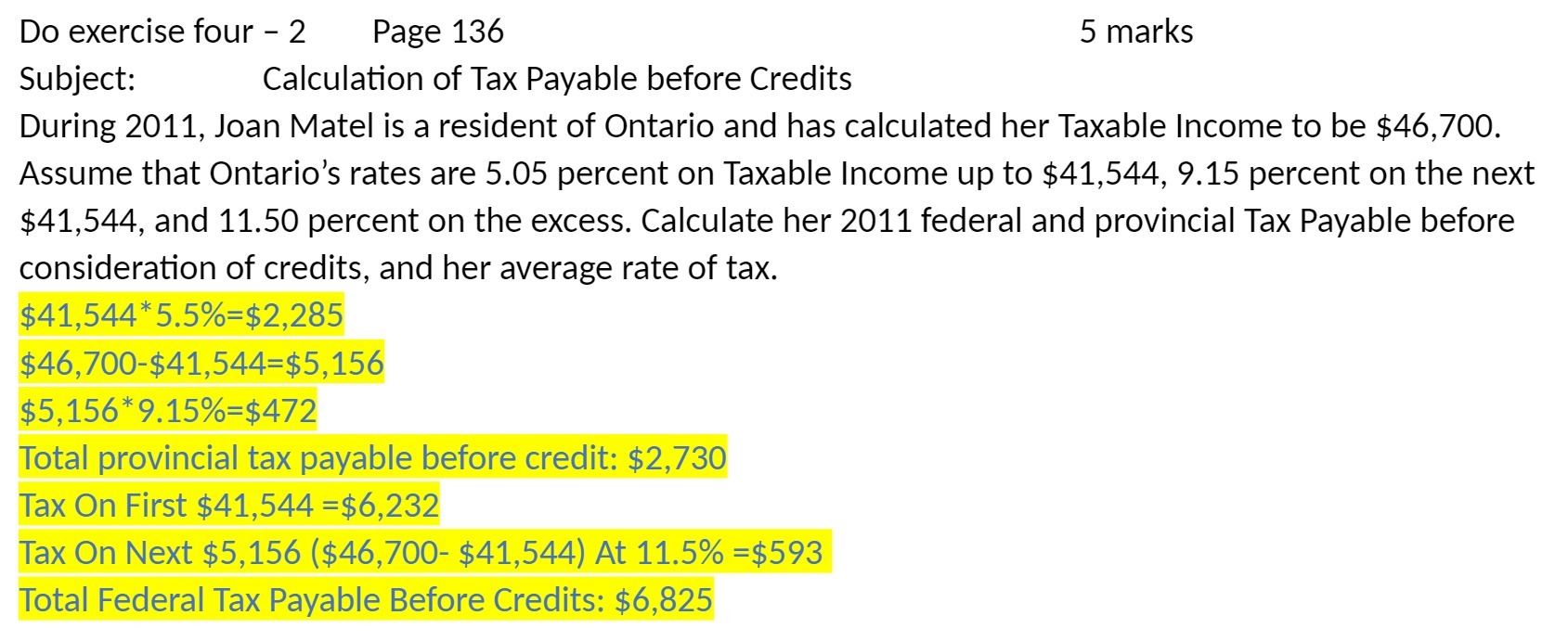

Do exercise four 2 Page 136 5 marks Subject: Calculation of Tax Payable before Credits During 2011, Joan Matel is a resident of Ontario and has calculated her Taxable Income to be $46,700. Assume that Ontario's rates are 5.05 percent on Taxable Income up to $41,544, 9.15 percent on the next $41,544, and 11.50 percent on the excess. Calculate her 2011 federal and provincial Tax Payable before consideration of credits, and her average rate of tax. $41,544*5.5%=$2,285 $46,700-$41,544=$5,156 $5,156*9.15%=$472 Total provincial tax payable before credit: $2,730 Tax On First $41,544 =$6,232 Tax On Next $5,156 ($46,700- $41,544) At 11.5% =$593 Total Federal Tax Payable Before Credits: $6,825

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts