Question: Do Hamewark Owen Lockamon Google Chrame Secure https://www.mathxl.com/Student/PlayerHomework.aspx2homeworkld 4651667 d = 1 0&flushed = false&cid zd8440 1 8¢erwin=yes FIN 315-04D: Business Finance I (SP18) Owen

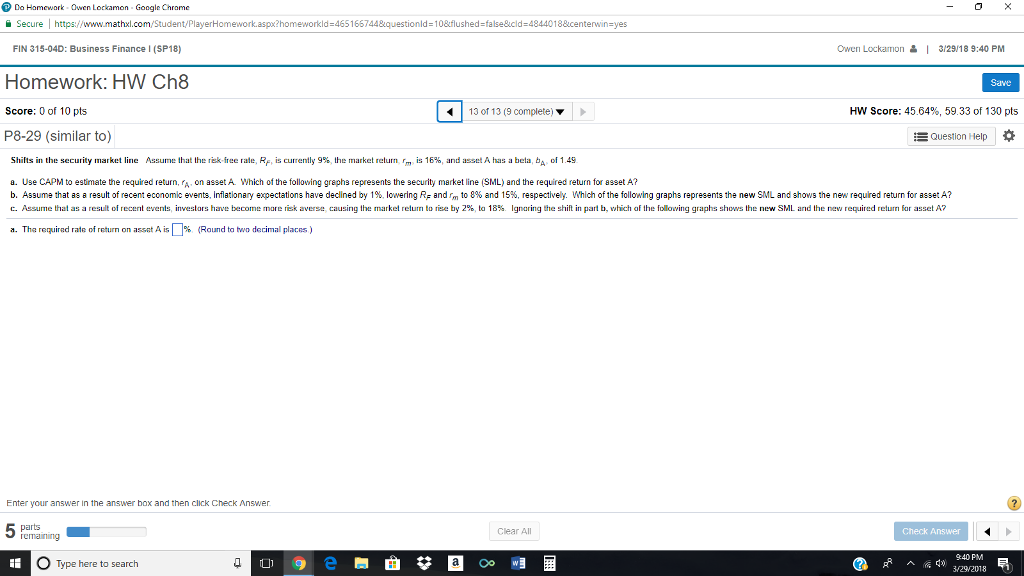

Do Hamewark Owen Lockamon Google Chrame Secure https://www.mathxl.com/Student/PlayerHomework.aspx2homeworkld 4651667 d = 1 0&flushed = false&cid zd8440 1 8¢erwin=yes FIN 315-04D: Business Finance I (SP18) Owen Lockarnon | 3/29/18 9:40 PM Homework: HW Ch8 Score: 0 of 10 pts P8-29 (similar to) Save 130113 ?9 complete) ? HW Score: 45.64%, 59.33 of 130 pts Question Help Shifts in the security market line Assume that the tek free rate, R is currently 9% the market return r , is 16%, and asset A has a beta of 1 49 a. Use CAPM to estimate the required return, ra on assetA. Which of the following graphs represents the security market line (SML) and the required return for asset A? b. Assume that as a result o recent economic events nflationary e pectations have declined by 9 owering RF and to 8% and 15%, respect vely. Wh ch o the following graphs represents the new SA L and shows the new requred return for asset A? ? ssume hat as a result of recent events investors have becomernare averse causing the markel return w mse b 2%, to 89 gnanng the shift in part b which a the folo lng graphs shows e new SM and the new required return for asset ? . The requirad rate of return on asset A is% (Round to two decimal places) Enter your answer in the answer box and then click Check Answer Clear All Check Answer 40 PM O Type here to search 3/29/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts