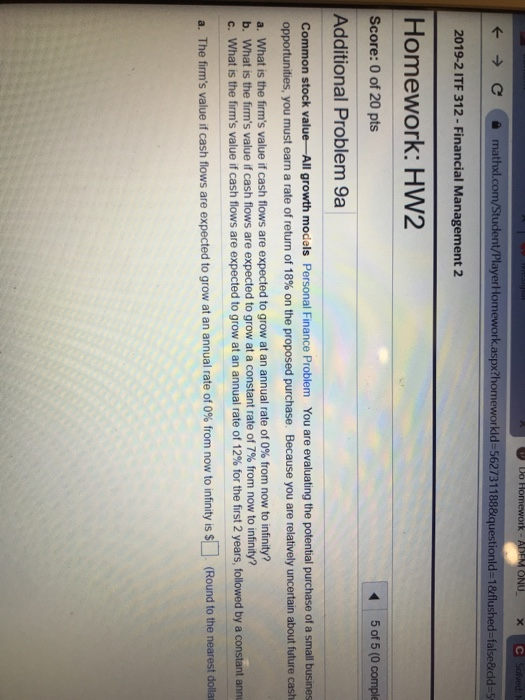

Question: Do Homework - ABEM ONU X C Solved: N C mathd.com/Student/Player Homework.aspx?homeworkId=562731188&questionid=1&flushed=false&cd= 2019-2 ITF 312 - Financial Management 2 Homework: HW2 5 of 5 (0

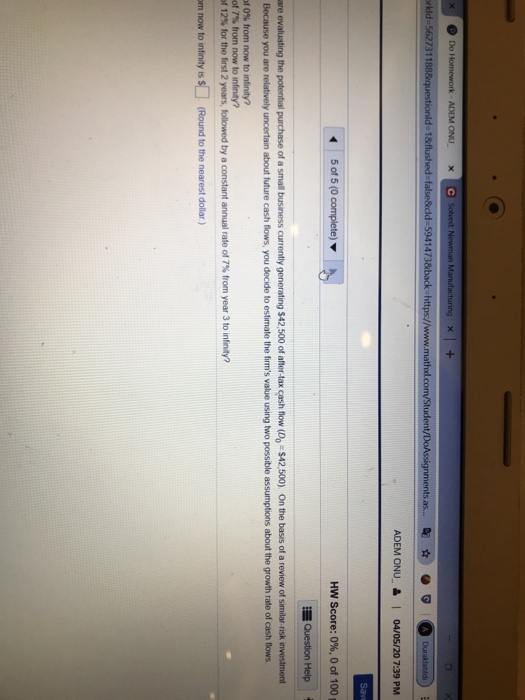

Do Homework - ABEM ONU X C Solved: N C mathd.com/Student/Player Homework.aspx?homeworkId=562731188&questionid=1&flushed=false&cd= 2019-2 ITF 312 - Financial Management 2 Homework: HW2 5 of 5 (0 comple Score: 0 of 20 pts Additional Problem 9a Common stock value-All growth models Personal Finance Problem You are evaluating the potential purchase of a small busines opportunities, you must earn a rate of return of 18% on the proposed purchase. Because you are relatively uncertain about future cast a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value if cash flows are expected to grow at a constant rate of 7% from now to infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of 12% for the first 2 years, followed by a constant annu (Round to the nearest dolla a. The firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity is $ Do Homework - ADEM ONU. x c Solved: Newman Manufacturing + orkid 5627311888 questionid=1&flushed-false&cd=5941473&back https://www.mathad.com/Student/Dossignments as... A Duraklatildi) ADEM ONU & 04/05/20 7:39 PM Save 5 of 5 (0 complete) HW Score: 0%, 0 of 100 Question Help are evaluating the potential purchase of a small business currently generating S42,500 of after-tax cash flow (Do-S42,500) On the basis of a review of similar-risk investment Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using two possible assumptions about the growth rate of cash flows of 0% from now to infinity? of 7% from now to infinity? of 12% for the first 2 years, followed by a constant annual rate of 7% from year 3 to infinity? om now to infinity is $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts