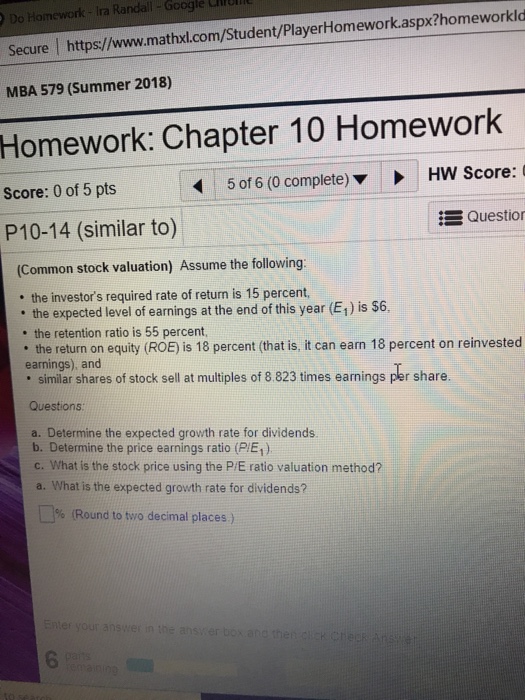

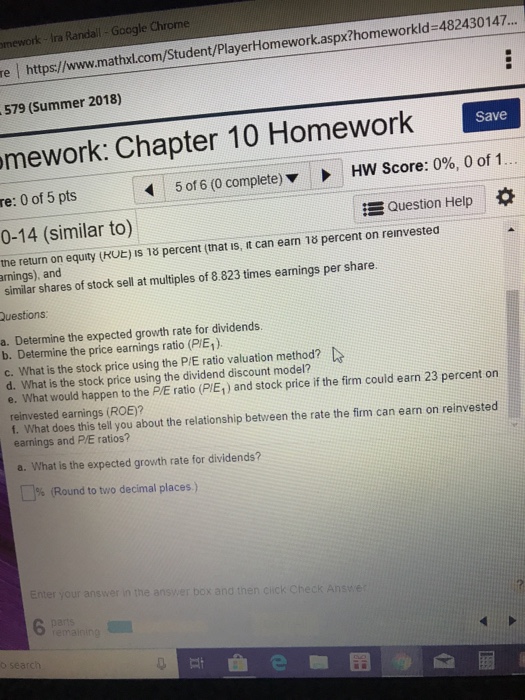

Question: Do Homework- Ira Randall- Google C Secure https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkld MBA 579 (Summer 2018) Homework: Chapter 10 Homework Score: 0 of 5 pts P10-14 (similar to) 5

Do Homework- Ira Randall- Google C Secure https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkld MBA 579 (Summer 2018) Homework: Chapter 10 Homework Score: 0 of 5 pts P10-14 (similar to) 5 of 6 (0 complete)HW Score: : Question (Common stock valuation) Assume the following the investor's required rate of return is 15 percent, the expected level of earnings at the end of this year (E1) is S6. , the retention ratio is 55 percent, the return on equity (ROE) is 18 percent (that is, it can earn 18 percent on reinvested earnings), and : similar shares of stock sell at multiples of 8 823 times earnings per share Questions: a. Determine the expected growth rate for dividends b. Determine the price earnings ratio (PIE1). c. What is the stock price using the P/E ratio valuation method? a. What is the expected growth rate for dividends? % (Round to two decimal places ) 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts