Question: Do Homework - Joah Sans Google Chrome matha.com/Student/PlayerHomework aspalhomeworkid=5540000738 question d u shedeflacid-5854607&_centerwinnyes BA335000220193 - FINANCIAL MANAGEMENT Josiah Sears & 04/27/20 3:09 Homework: Chapter 14

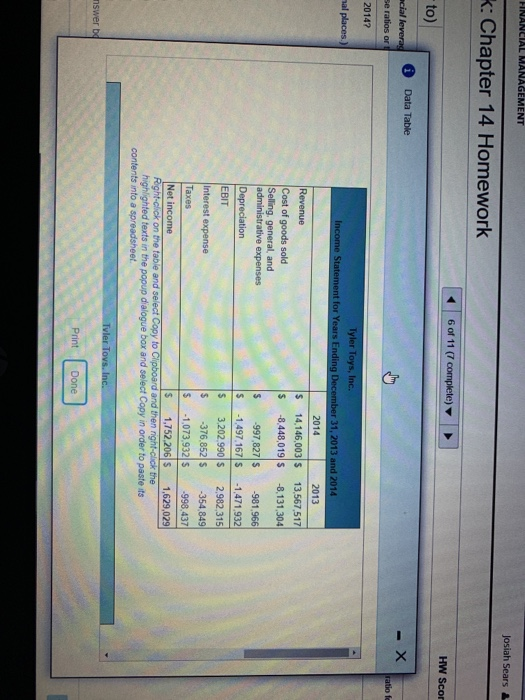

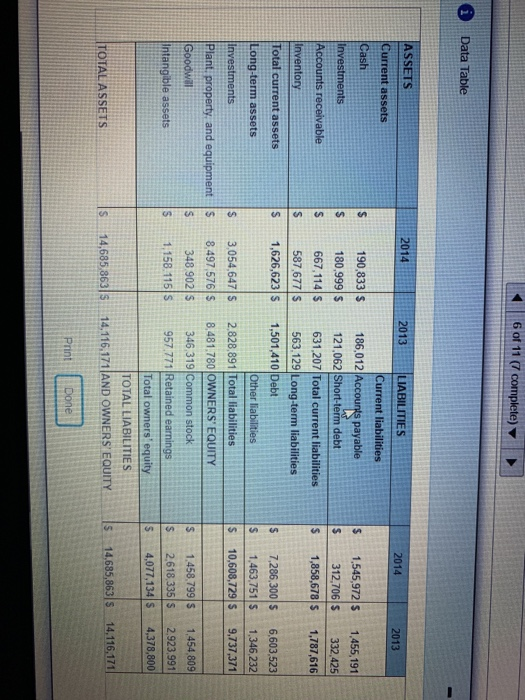

Do Homework - Joah Sans Google Chrome matha.com/Student/PlayerHomework aspalhomeworkid=5540000738 question d u shedeflacid-5854607&_centerwinnyes BA335000220193 - FINANCIAL MANAGEMENT Josiah Sears & 04/27/20 3:09 Homework: Chapter 14 Homework Score: 0 of 1 pt + 6 of 11 (7 complete) HW Score: 47.41%, 5 22 of P14-10 (similar to) Question Help Financial ratios: Financial leverage. The financial Statements for Tyler Toys, Inc. are shown in the popup Window Calculate the debattimes interest earned ratio, and cash coverage rate for 2013 and 2014 for Ty Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the debt ratio for 2014? (Round to four decimal places) Question Viewer Enter your answer in the answer box and then click Check Answer HINANCIAL MANAGEMENT Josiah Sears & k: Chapter 14 Homework 6 of 117 complete) HW Scor i Data Table to) cial leverag se ratios or 2014? - X ratio fc mal places.) /s Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue S 14,146,003 S 13,567,517 Cost of goods sold S -8.448,019 S -8,131,304 Selling, general, and administrative expenses -997,827 S 981,966 Depreciation $ -1,497 167 s -1,471,932 EBIT S 3.202.990 S 2.982 315 Interest expense -376,852 -354849 Taxes % -1,073,932 998,437 Net income $ 1,752,206 $ 1,629,029 Right click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet Tyler Tovs, Inc. nswer be Print | Done 6 of 11 (1 complete) Data Table ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets Cash Investments 190,833 180,999 $ 667,114 587,677 1,626,623 S 1.545,972 5 312,706 5 1,858,678 $ 1,455,191 332,425 1,787,616 Accounts receivable Inventory Total current assets Long-term assets Investments Plant, property, and equipment Goodwill Current liabilities 186,012 Accounts payable 121,062 Short-term debt 631,207 Total current liabilities 563,129 Long-term liabilities 1,501,410 Debt Other liabilities 2.828,891 Total liabilities 8.481.780 OWNERS' EQUITY 346 319 Common stock 957.771 Retained earnings Total owners' equity TOTAL LIABILITIES 14,116,171 AND OWNERS' EQUITY $ $ $ 7,286,300 S 1,463,751 $ 10,608,729 $ 6,603,523 1,346,232 9,737,371 $ $ 3,054,6475 8,497,576 $ 348 902 5 1,158.115 $ $ $ Intangible assets 1.458,799 $ 2618,335 $ 4,077,134 S 1,454 809 2.923.991 4,378,800 TOTAL ASSETS S 14,685 863) 15 14,685,863514,116,171 Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts