Question: do it handwritten and be fast Question 2 centres sa isa private company and its a management accountant is analyzing the performance of the investment

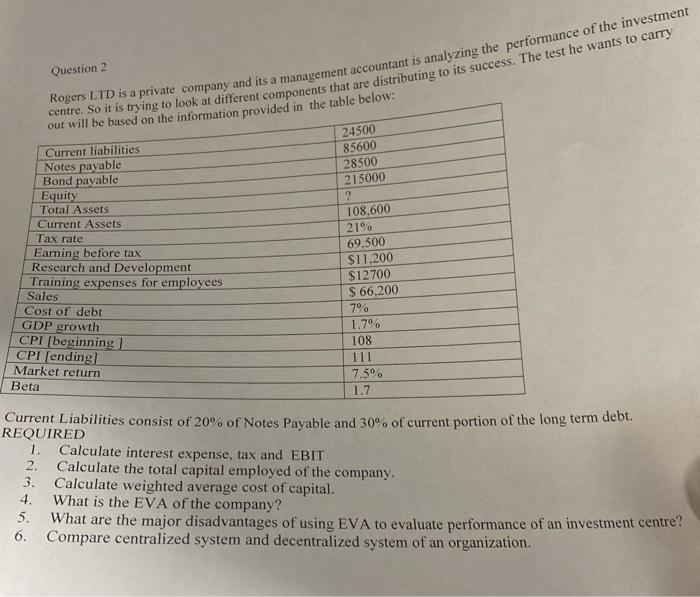

Question 2 centres sa isa private company and its a management accountant is analyzing the performance of the investment out will be based on the information provided in the table below: centre, So it is trying to look at different components that are distributing to its success. The test he wants to carry Current liabilities Notes payable Bond payable Equity Total Assets Current Assets Tax rate Eaming before tax Research and Development Training expenses for employees Sales Cost of debt GDP growth CPI [beginning CPI (ending] Market return Beta Current Liabilities consist of 20% of Notes Payable and 30% of current portion of the long term debt. REQUIRED 1 Calculate interest expense, tax and EBIT 2. Calculate the total capital employed of the company. 3. Calculate weighted average cost of capital. 4. What is the EVA of the company? 5. What are the major disadvantages of using EVA to evaluate performance of an investment centre? 6. Compare centralized system and decentralized system of an organization. 24500 85600 28500 215000 ? 108,600 21% 69,500 $11.200 $12700 S 66,200 70% 1.7% 108 111 7.5% 1.7 Question 2 centres sa isa private company and its a management accountant is analyzing the performance of the investment out will be based on the information provided in the table below: centre, So it is trying to look at different components that are distributing to its success. The test he wants to carry Current liabilities Notes payable Bond payable Equity Total Assets Current Assets Tax rate Eaming before tax Research and Development Training expenses for employees Sales Cost of debt GDP growth CPI [beginning CPI (ending] Market return Beta Current Liabilities consist of 20% of Notes Payable and 30% of current portion of the long term debt. REQUIRED 1 Calculate interest expense, tax and EBIT 2. Calculate the total capital employed of the company. 3. Calculate weighted average cost of capital. 4. What is the EVA of the company? 5. What are the major disadvantages of using EVA to evaluate performance of an investment centre? 6. Compare centralized system and decentralized system of an organization. 24500 85600 28500 215000 ? 108,600 21% 69,500 $11.200 $12700 S 66,200 70% 1.7% 108 111 7.5% 1.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts