Question: do it in Excel if possible please. Given the following information regarding an income producing property, determine the after-tax net present value (NPV) expected holding

do it in Excel if possible please.

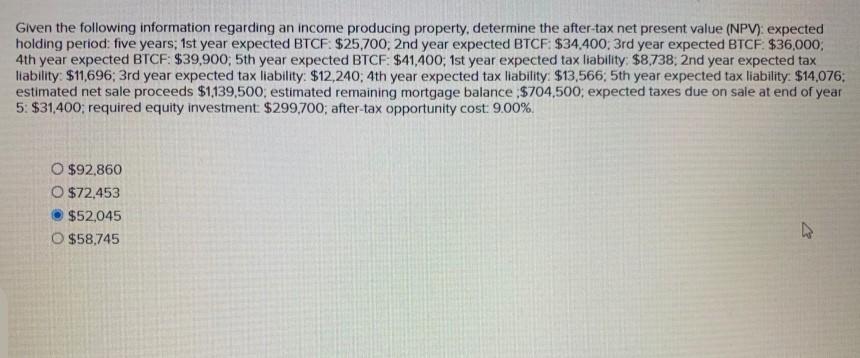

Given the following information regarding an income producing property, determine the after-tax net present value (NPV) expected holding period: five years; 1st year expected BTCF $25,700, 2nd year expected BTCF $34.400, 3rd year expected BTCF $36,000, 4th year expected BTCF: $39,900, 5th year expected BTCF: $41,400; 1st year expected tax liability: $8,738, 2nd year expected tax liability: $11,696; 3rd year expected tax liability: $12,240; 4th year expected tax liability: $13,566, 5th year expected tax liability: $14,076: estimated net sale proceeds $1139,500, estimated remaining mortgage balance $704,500; expected taxes due on sale at end of year 5: $31,400; required equity investment $299,700, after-tax opportunity cost: 9.00%. O $92,860 O $72,453 $52,045 O $58,745

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts