Question: do it in Excel if possible please. Given the following information regarding an income-producing property, determine the NPV using levered cash flows in your analysis:

do it in Excel if possible please.

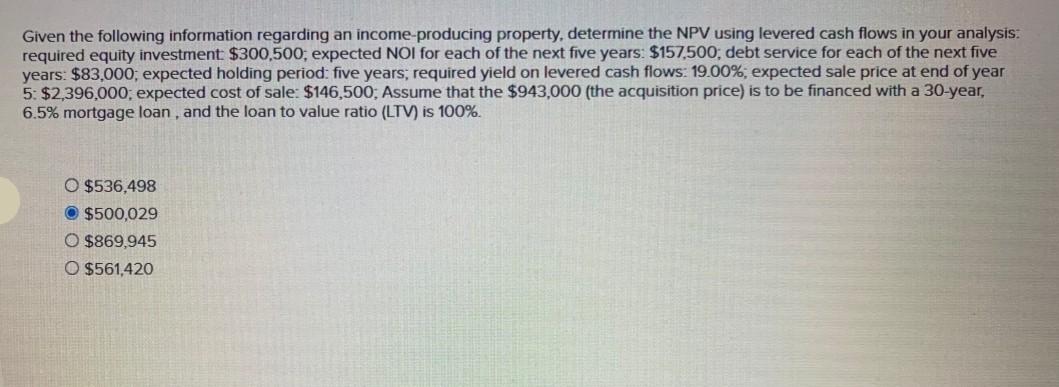

Given the following information regarding an income-producing property, determine the NPV using levered cash flows in your analysis: required equity investment $300,500, expected NOI for each of the next five years: $157,500, debt service for each of the next five years: $83,000; expected holding period: five years, required yield on levered cash flows: 19.00%; expected sale price at end of year 5:$2,396,000; expected cost of sale: $146,500; Assume that the $943,000 (the acquisition price) is to be financed with a 30-year, 6.5% mortgage loan, and the loan to value ratio (LTV) is 100% O $536,498 $500,029 O $869,945 O $561,420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts