Question: do it in excel You are considering purchasing a machine to produce golf balls. The cost of the thachine is 5100000 and its expected life

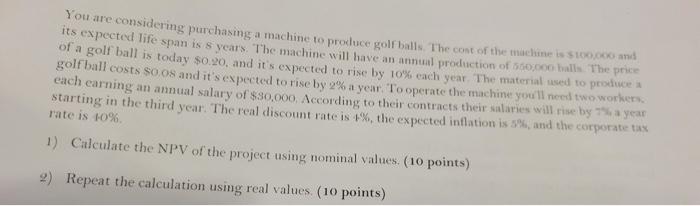

You are considering purchasing a machine to produce golf balls. The cost of the thachine is 5100000 and its expected life span is 8 years. The machine will have an annuil production of 5 pogon balls The price of a golf ball is today $0.20, and it 's expected to rise by 10th each year. The material used to prodiwce a golf ball costs soos and it's expected to rise by 2% a year. To operate the machine youll need two worker. each carning an annual salary of $30,000. According to their contracts their salaries will rise by 7% a year starting in the third year. The real discount rate is 4%, the expected inflation is 58 , and the corporate tax rate is 10%. 1) Citculate the NPV of the project using nominal values. (10 points) 2) Repeat the calculation using real values. ( 10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts