Question: do it on page hand written work required please ABC's Sale president believes that annual sales would be 40,000 units with an increase of 10

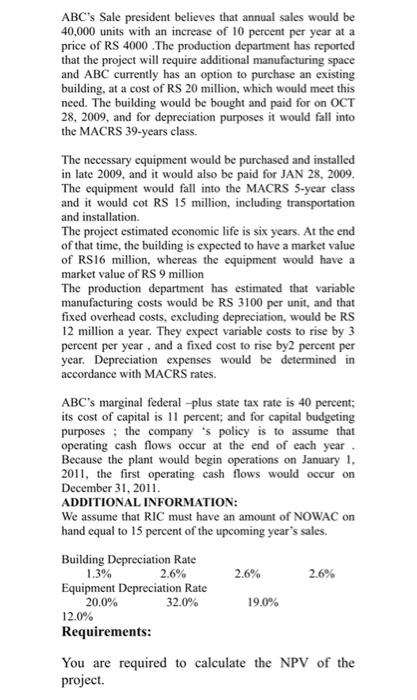

ABC's Sale president believes that annual sales would be 40,000 units with an increase of 10 percent per year at a price of RS 4000. The production department has reported that the project will require additional manufacturing space and ABC currently has an option to purchase an existing building, at a cost of Rs 20 million, which would meet this need. The building would be bought and paid for on OCT 28, 2009, and for depreciation purposes it would fall into the MACRS 39-years class. The necessary equipment would be purchased and installed in late 2009, and it would also be paid for JAN 28, 2009. The equipment would fall into the MACRS 5-year class and it would cot RS 15 million, including transportation and installation The project estimated economic life is six years. At the end of that time, the building is expected to have a market value of RS16 million, whereas the equipment would have a market value of RS 9 million The production department has estimated that variable manufacturing costs would be RS 3100 per unit, and that fixed overhead costs, excluding depreciation, would be RS 12 million a year. They expect variable costs to rise by 3 percent per year, and a fixed cost to rise by2 percent per year. Depreciation expenses would be determined in accordance with MACRS rates. ABC's marginal federal-plus state tax rate is 40 percent; its cost of capital is 11 percent; and for capital budgeting purposes ; the company's policy is to assume that operating cash flows occur at the end of each year Because the plant would begin operations on January 1, 2011, the first operating cash flows would occur on December 31, 2011. ADDITIONAL INFORMATION: We assume that RIC must have an amount of NOWAC on hand equal to 15 percent of the upcoming year's sales. Building Depreciation Rate 1.3% 2.6% 2.6% Equipment Depreciation Rate 20.0% 32.0% 19.0% 12.0% Requirements: You are required to calculate the NPV of the project. 2.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts