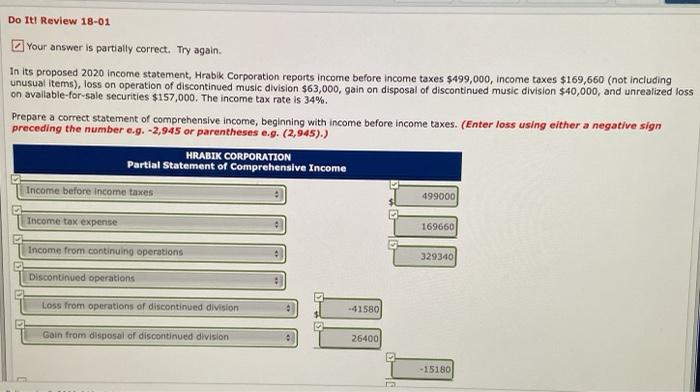

Question: Do It! Review 18-01 Your answer is partially correct. Try again. In its proposed 2020 income statement, Hrabik Corporation reports income before income taxes $499,000,

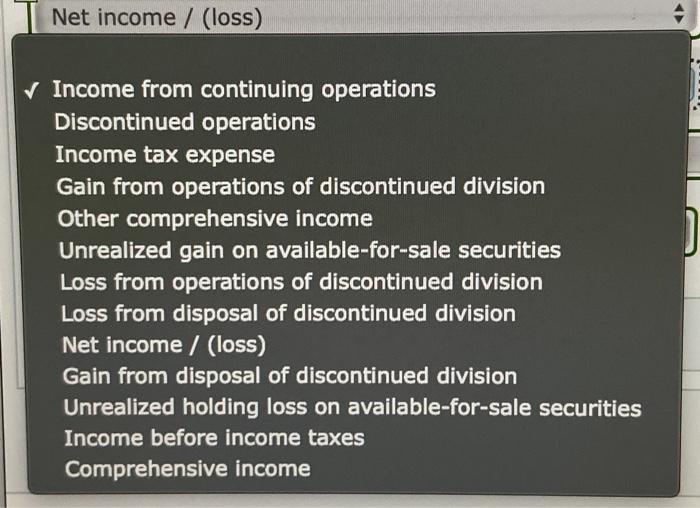

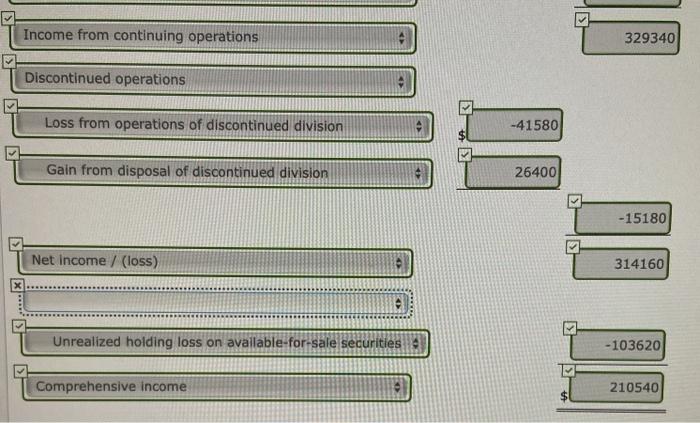

Do It! Review 18-01 Your answer is partially correct. Try again. In its proposed 2020 income statement, Hrabik Corporation reports income before income taxes $499,000, income taxes $169,660 (not including unusual items), loss on operation of discontinued music division $63,000, gain on disposal of discontinued music division $40,000, and unrealized loss on available for sale securities $157,000. The income tax rate is 34%. Prepare a correct statement of comprehensive Income, beginning with income before income taxes. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) HRABIK CORPORATION Partial Statement of Comprehensive Income Income before income taxes 499000 Income tax expense 169660 Income from continuing operations 0 - 329340 Discontinued operations Loss from operations of discontinued division 41580 Gain from disposal of discontinued division 26400 -15180 4 Net income / (loss) Income from continuing operations Discontinued operations Income tax expense Gain from operations of discontinued division Other comprehensive income Unrealized gain on available-for-sale securities Loss from operations of discontinued division Loss from disposal of discontinued division Net income / (loss) Gain from disposal of discontinued division Unrealized holding loss on available-for-sale securities Income before income taxes Comprehensive income Income from continuing operations 329340 Discontinued operations Loss from operations of discontinued division -41580 Gain from disposal of discontinued division 26400 -15180 Net Income / (loss) 314160 Unrealized holding loss on available-for-sale securities -103620 Comprehensive income 210540

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts