Question: do it right in right way Measure Evalute Control Transition Management Implemen Chang Eristal Naturo im pest of the Automobile indietry i powing at the

do it right in right way

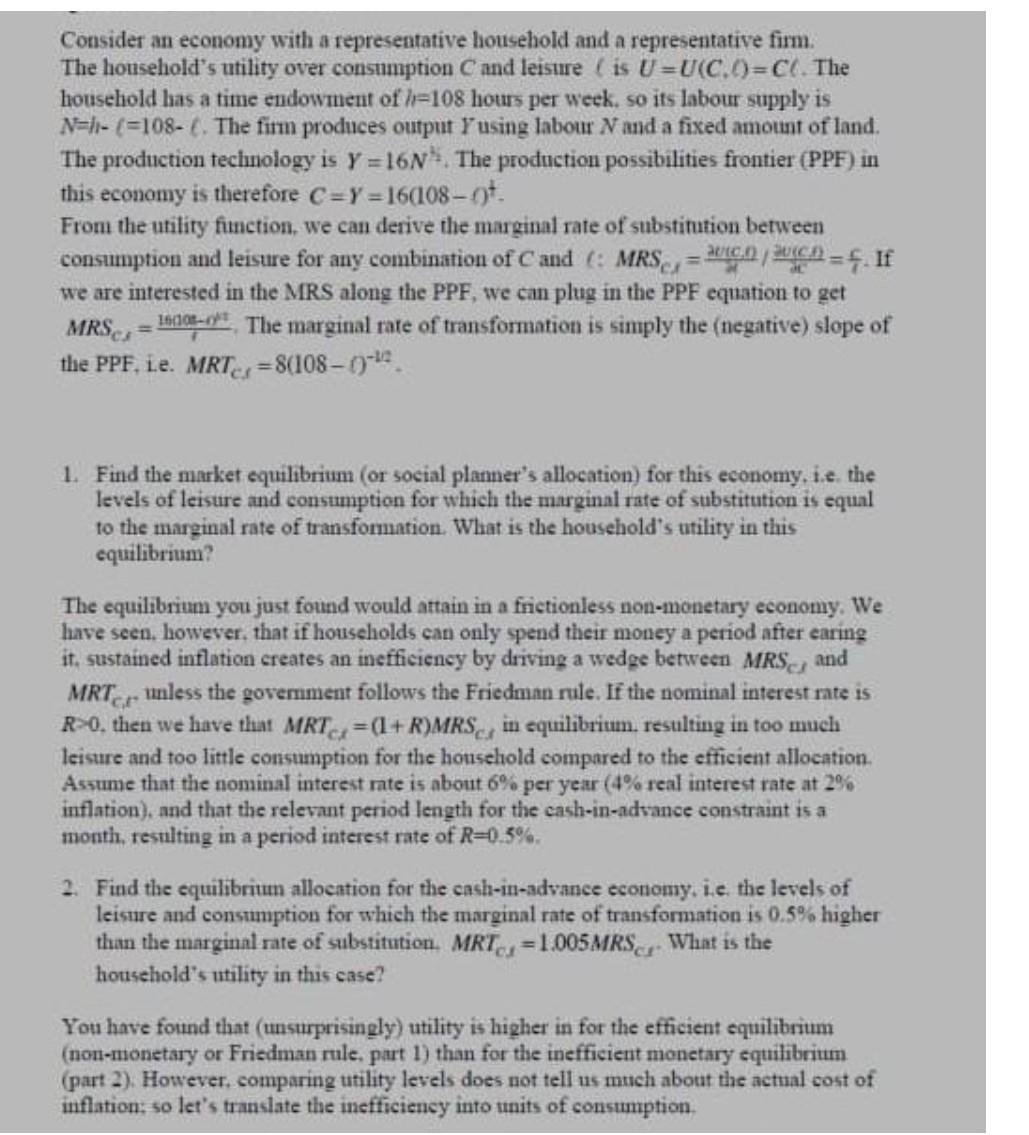

Measure Evalute Control Transition Management Implemen Chang Eristal Naturo im pest of the Automobile indietry i powing at the of Materih prema in the sest is appel Ven legal development is the industry expert te madhore 1 All of the the upper und eine be of middle 1 for establishing tacturing Export Import and and anale et stories can be small and medium scule to mislite wallatite Com ferme tot and is eing that perference for chesion is increasing Consider an economy with a representative household and a representative firm. The household's utility over consumption and leisure ( is U=U(C.OEC. The household has a time endowment of =108 hours per week. so its labour supply is N=1 - (=108-. The firm produces output Yusing labour N and a fixed amount of land. The production technology is Y =16N. The production possibilities frontier (PPF) in this economy is therefore C=Y = 16(108 - . From the utility function, we can derive the marginal rate of substitution between consumption and leisure for any combination of Cand: MRS, CORCA) = f If we are interested in the MRS along the PPF, we can plug in the PPF equation to get MRSA 16:100_// The marginal rate of transformation is simply the negative) slope of the PPF, Le. MRT,=8(108-0- 1. Find the market equilibrium (or social planner's allocation for this economy. i.e. the levels of leisure and consumption for which the marginal rate of stubstitution is equal to the marginal rate of transformation. What is the household's utility in this equilibrium? The equilibrium you just found would attain in a frictionless non-monetary economy. We have seen, however, that if households can only spend their money a period after caring it, sustained inflation creates an inefficiency by driving a wedge between MRS and MRT, unless the government follows the Friedman rule. If tie nominal interest rate is R-0. then we have thunt MRT =(1+R)MRS, in equilibrium, resulting in too much leisure and too little consumption for the household compared to the efficient allocation. Assume that the nominal interest rate is about 6% per year (1% real interest rate at 2% inflation), and that the relevant period length for the cash-in-advance constraint is a month, restulting in a period interest rate of R=0 3%. 2. Find the equilibritun allocation for the cash-in-advance economy. ie the levels of leisure and consumption for which the marginal rate of transformation is 0.5% higher than the marginal rate of substitution. MRT, = 1.005MRS.. What is the household's utility in this case! You have found that (unsurprisingly) utility is higher in for the efficient equilibrium (non-monetary or Friedman rule, part 1) than for the inefficient monetary equilibrium (part 2). However, comparing utility lesels does not tell us much about the actual cost of inflation, so let's translate the inefficiency into tunits of consttmptionStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock