Question: do it together Question Answer Marks 4axi) Refer to lines 49,57 and Table 1. Calculate: 3 gearing ratio assuming all $60 m is obtained from

do it together

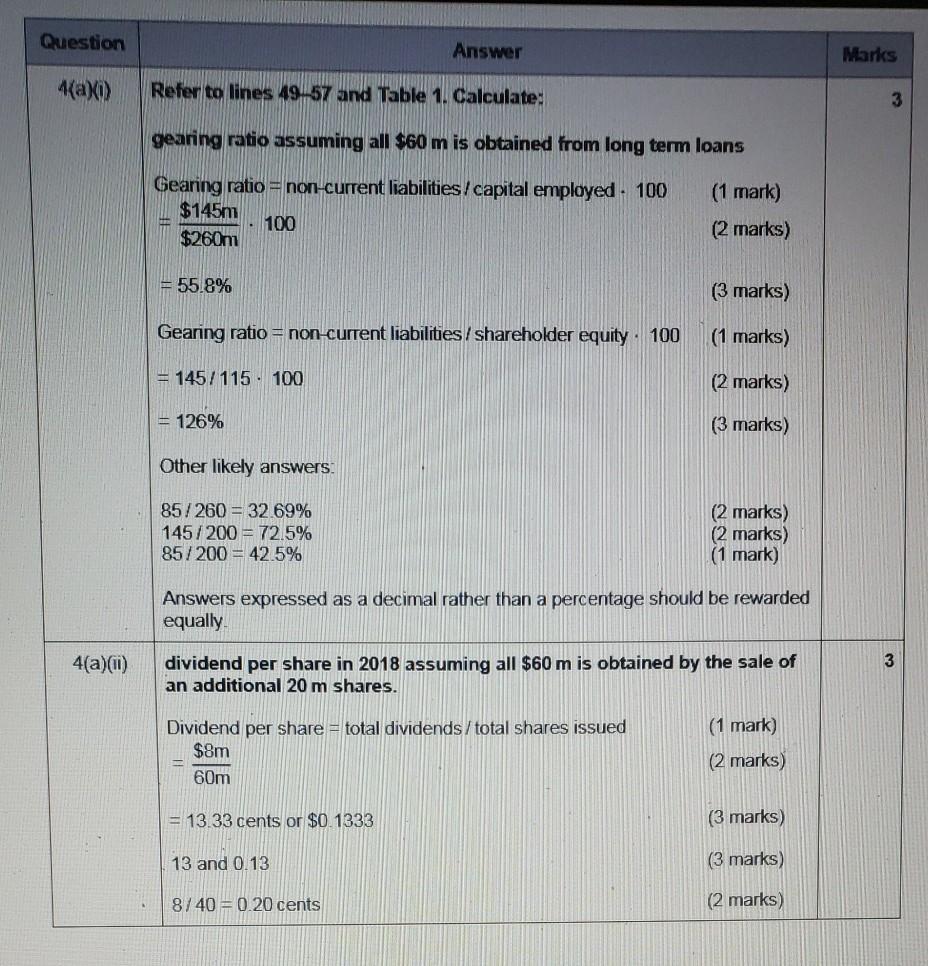

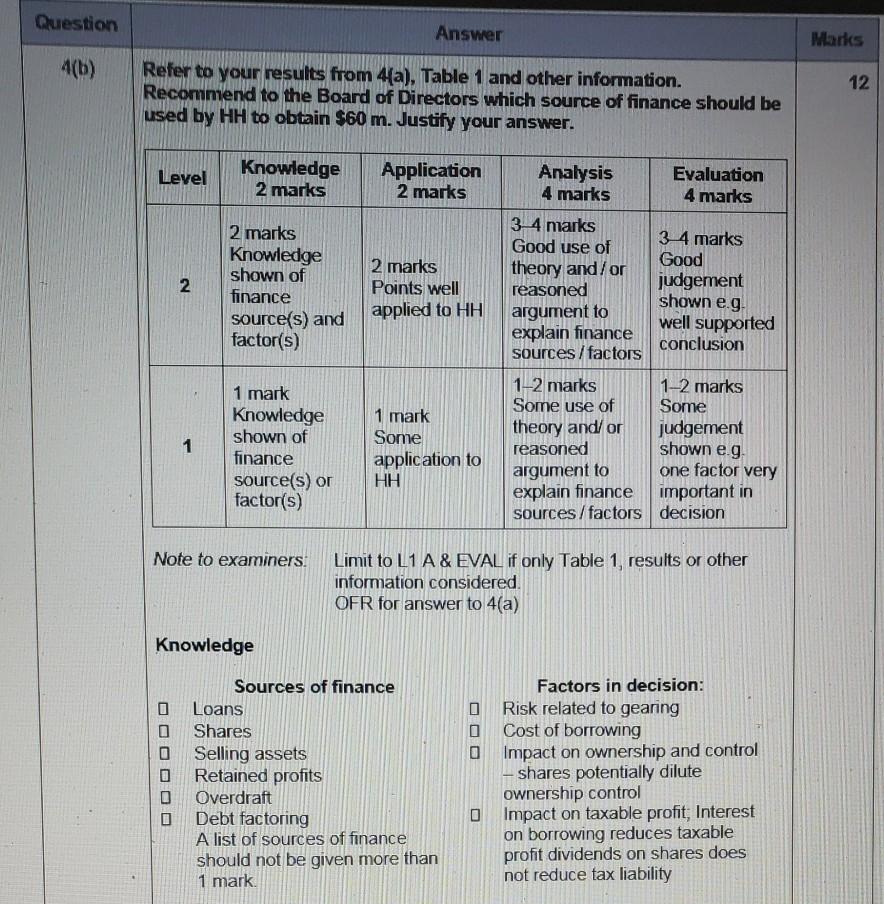

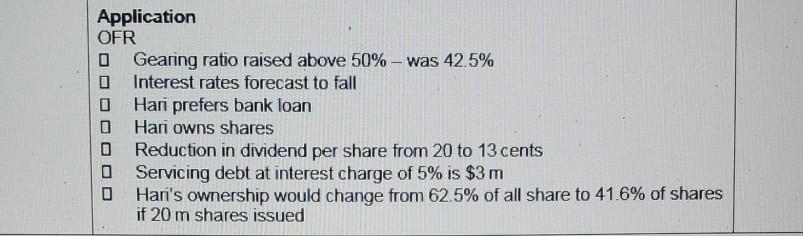

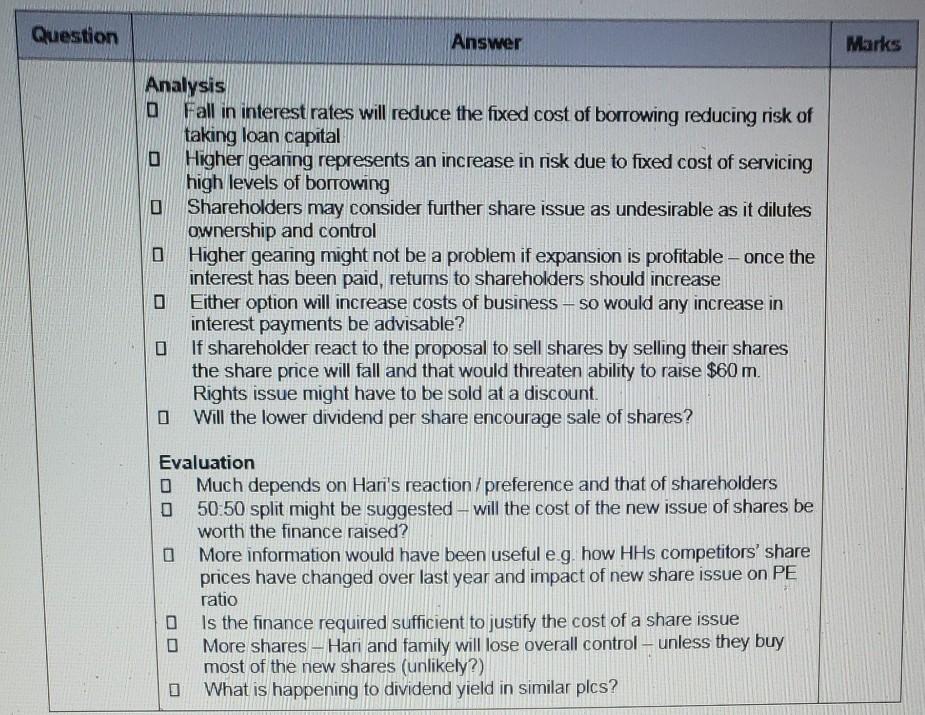

Question Answer Marks 4axi) Refer to lines 49,57 and Table 1. Calculate: 3 gearing ratio assuming all $60 m is obtained from long term loans Gearing ratio=non-current liabilities/ capital employed - 100 $145m $260m (1 mark) (2 marks) 100 = 55.8% (3 marks) Gearing ratio = non-current liabilities/shareholder equity 100 (1 marks) = 145/115. 100 (2 marks) = 126% (3 marks) Other likely answers. 85/260 = 32 69% 145/200 = 72.5% 85/200 = 42.5% (2 marks) (2 marks) (1 mark) Answers expressed as a decimal rather than a percentage should be rewarded equally 4(a)(ii) dividend per share in 2018 assuming all $60 m is obtained by the sale of an additional 20 m shares. Dividend per share = total dividends/total shares issued $8m 60m (1 mark) (2 marks) = 13.33 cents or $0.1333 (3 marks) 13 and 0.13 (3 marks) 8/40 = 0.20 cents (2 marks) Question Answer Marks 4(b) 12 Refer to your results from 4a), Table 1 and other information. Recommend to the Board of Directors which source of finance should be used by HH to obtain $60 m. Justify your answer. Level Knowledge 2 marks Application 2 marks 2 2 marks Knowledge shown of finance source(s) and factor(s) 2 marks Points well applied to HH shown e.g Analysis Evaluation 4 marks 4 marks 3 4 marks Good use of 3 4 marks Good theory and/or reasoned judgement argument to well supported explain finance conclusion sources/factors 1-2 marks 1-2 marks Some use of Some theory and/or judgement reasoned shown eg argument to one factor very explain finance important in sources/factors decision 1 1 mark Knowledge shown of finance source(s) or factor(s) 1 mark ome application to HH Note to examiners. Limit to L1 A & EVAL if only Table 1, results or other information considered. OFR for answer to 4(a) Knowledge O Sources of finance Loans Shares Selling assets Retained profits Overdraft Debt factoring A list of sources of finance should not be given more than 1 mark. Factors in decision: Risk related to gearing Cost of borrowing Impact on ownership and control - shares potentially dilute ownership control 0 Impact on taxable profit; Interest on borrowing reduces taxable profit dividends on shares does not reduce tax liability Application OFR Geaning ratio raised above 50% - was 42.5% Interest rates forecast to fall Hari prefers bank loan 0 Hari owns shares 0 Reduction in dividend per share from 20 to 13 cents O Servicing debt at interest charge of 5% is $3 m Han's ownership would change from 62.5% of all share to 41.6% of shares if 20 m shares issued Question Answer Marks Analysis Fall in interest rates will reduce the fixed cost of borrowing reducing risk of taking loan capital 0 Higher geanng represents an increase in risk due to fixed cost of servicing high levels of borrowing Shareholders may consider further share issue as undesirable as it dilutes ownership and control D Higher gearing might not be a problem if expansion is profitable - once the interest has been paid, retums to shareholders should increase Either option will increase costs of business - so would any increase in interest payments be advisable? If shareholder react to the proposal to sell shares by selling their shares the share price will fall and that would threaten ability to raise $60 m. Rights issue might have to be sold at a discount. Will the lower dividend per share encourage sale of shares? Evaluation Much depends on Hari's reaction/preference and that of shareholders 50:50 split might be suggested - will the cost of the new issue of shares be worth the finance raised? More information would have been useful eg how HHs competitors' share prices have changed over last year and impact of new share issue on PE ratio Is the finance required sufficient to justify the cost of a share issue More shares - Hari and family will lose overall control - unless they buy most of the new shares (unlikely?) What is happening to dividend yield in similar pics? Question Answer Marks 4axi) Refer to lines 49,57 and Table 1. Calculate: 3 gearing ratio assuming all $60 m is obtained from long term loans Gearing ratio=non-current liabilities/ capital employed - 100 $145m $260m (1 mark) (2 marks) 100 = 55.8% (3 marks) Gearing ratio = non-current liabilities/shareholder equity 100 (1 marks) = 145/115. 100 (2 marks) = 126% (3 marks) Other likely answers. 85/260 = 32 69% 145/200 = 72.5% 85/200 = 42.5% (2 marks) (2 marks) (1 mark) Answers expressed as a decimal rather than a percentage should be rewarded equally 4(a)(ii) dividend per share in 2018 assuming all $60 m is obtained by the sale of an additional 20 m shares. Dividend per share = total dividends/total shares issued $8m 60m (1 mark) (2 marks) = 13.33 cents or $0.1333 (3 marks) 13 and 0.13 (3 marks) 8/40 = 0.20 cents (2 marks) Question Answer Marks 4(b) 12 Refer to your results from 4a), Table 1 and other information. Recommend to the Board of Directors which source of finance should be used by HH to obtain $60 m. Justify your answer. Level Knowledge 2 marks Application 2 marks 2 2 marks Knowledge shown of finance source(s) and factor(s) 2 marks Points well applied to HH shown e.g Analysis Evaluation 4 marks 4 marks 3 4 marks Good use of 3 4 marks Good theory and/or reasoned judgement argument to well supported explain finance conclusion sources/factors 1-2 marks 1-2 marks Some use of Some theory and/or judgement reasoned shown eg argument to one factor very explain finance important in sources/factors decision 1 1 mark Knowledge shown of finance source(s) or factor(s) 1 mark ome application to HH Note to examiners. Limit to L1 A & EVAL if only Table 1, results or other information considered. OFR for answer to 4(a) Knowledge O Sources of finance Loans Shares Selling assets Retained profits Overdraft Debt factoring A list of sources of finance should not be given more than 1 mark. Factors in decision: Risk related to gearing Cost of borrowing Impact on ownership and control - shares potentially dilute ownership control 0 Impact on taxable profit; Interest on borrowing reduces taxable profit dividends on shares does not reduce tax liability Application OFR Geaning ratio raised above 50% - was 42.5% Interest rates forecast to fall Hari prefers bank loan 0 Hari owns shares 0 Reduction in dividend per share from 20 to 13 cents O Servicing debt at interest charge of 5% is $3 m Han's ownership would change from 62.5% of all share to 41.6% of shares if 20 m shares issued Question Answer Marks Analysis Fall in interest rates will reduce the fixed cost of borrowing reducing risk of taking loan capital 0 Higher geanng represents an increase in risk due to fixed cost of servicing high levels of borrowing Shareholders may consider further share issue as undesirable as it dilutes ownership and control D Higher gearing might not be a problem if expansion is profitable - once the interest has been paid, retums to shareholders should increase Either option will increase costs of business - so would any increase in interest payments be advisable? If shareholder react to the proposal to sell shares by selling their shares the share price will fall and that would threaten ability to raise $60 m. Rights issue might have to be sold at a discount. Will the lower dividend per share encourage sale of shares? Evaluation Much depends on Hari's reaction/preference and that of shareholders 50:50 split might be suggested - will the cost of the new issue of shares be worth the finance raised? More information would have been useful eg how HHs competitors' share prices have changed over last year and impact of new share issue on PE ratio Is the finance required sufficient to justify the cost of a share issue More shares - Hari and family will lose overall control - unless they buy most of the new shares (unlikely?) What is happening to dividend yield in similar pics

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts