Question: do it with proper presentation if you want vote this is complete question no other information available do the answer only if you know correctly

do it with proper presentation if you want vote

this is complete question no other information available

do the answer only if you know correctly

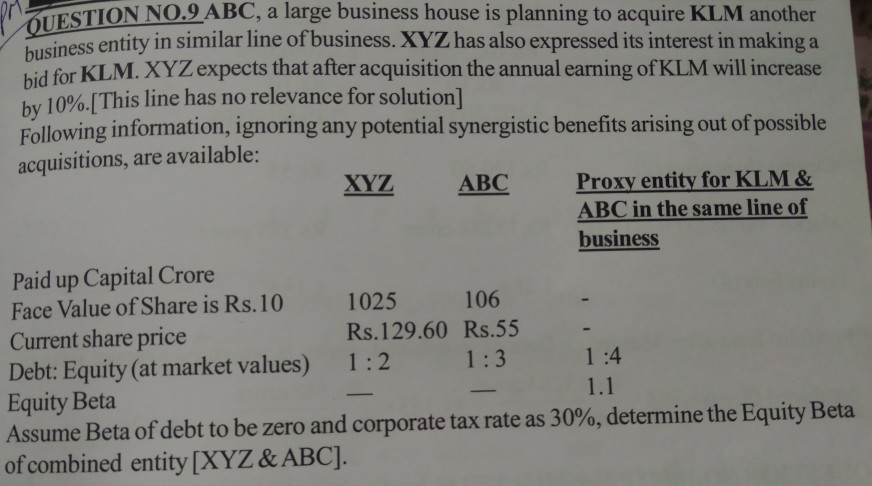

ESTION NO.9 ABC, a large business house is planning to acquire KLM another business entity iness entity in similar line of business. XYZ has also expressed its interest in making a for KLM. XYZ expects that after acquisition the annual earning of KLM will increase by 10%.[This line has no relevance for solution] Following information, ignoring any potential synergistic benefits arising out of possible acquisitions, are available: XYZ ABC Proxy entity for KLM & ABC in the same line of business Paid up Capital Crore Face Value of Share is Rs. 10 1025 106 Current share price Rs.129.60 Rs.55 Debt: Equity (at market values) 1:2 1:3 1:4 Equity Beta 1.1 Assume Beta of debt to be zero and corporate tax rate as 30%, determine the Equity Beta of combined entity [XYZ & ABC]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts