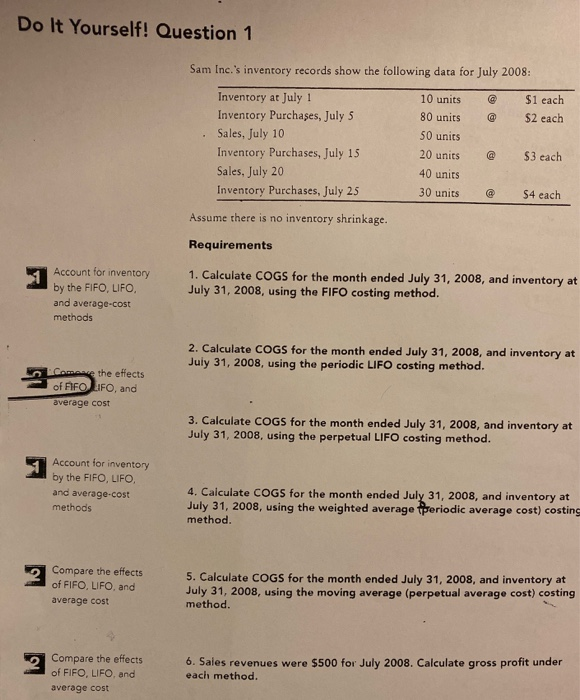

Question: Do It Yourself! Question 1 Sam Inc.'s inventory records show the following data for July 2008: @ @ $1 each $2 each Inventory at July

Do It Yourself! Question 1 Sam Inc.'s inventory records show the following data for July 2008: @ @ $1 each $2 each Inventory at July 1 Inventory Purchases, July 5 Sales, July 10 Inventory Purchases, July 15 Sales, July 20 Inventory Purchases, July 25 10 units 80 units 50 units 20 units 40 units 30 units @ $3 each @ $4 each Assume there is no inventory shrinkage. Requirements Account for inventory by the FIFO, LIFO. and average-cost methods 1. Calculate COGS for the month ended July 31, 2008, and inventory at July 31, 2008, using the FIFO costing method. 2. Calculate COGS for the month ended July 31, 2008, and inventory at July 31, 2008, using the periodic LIFO costing method. Comange the effects of FIFOLIFO, and average cost 3. Calculate COGS for the month ended July 31, 2008, and inventory at July 31, 2008, using the perpetual LIFO costing method. Account for inventory by the FIFO, LIFO and average-cost methods 4. Calculate COGS for the month ended July 31, 2008, and inventory at July 31, 2008, using the weighted average periodic average cost) costing method. Compare the effects of FIFO, LIFO, and average cost 5. Calculate COGS for the month ended July 31, 2008, and inventory at July 31, 2008, using the moving average (perpetual average cost) costing method. Compare the effects of FIFO, LIFO, and average cost 6. Sales revenues were $500 for July 2008. Calculate gross profit under each method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts