Question: Do maths for 2019 and 2020. And answer a & b 2 Balance Sheet Income Statement 3 Particulars: 4 Cash 5 Accounts Receivable 6 Stocks

Do maths for 2019 and 2020. And answer a & b

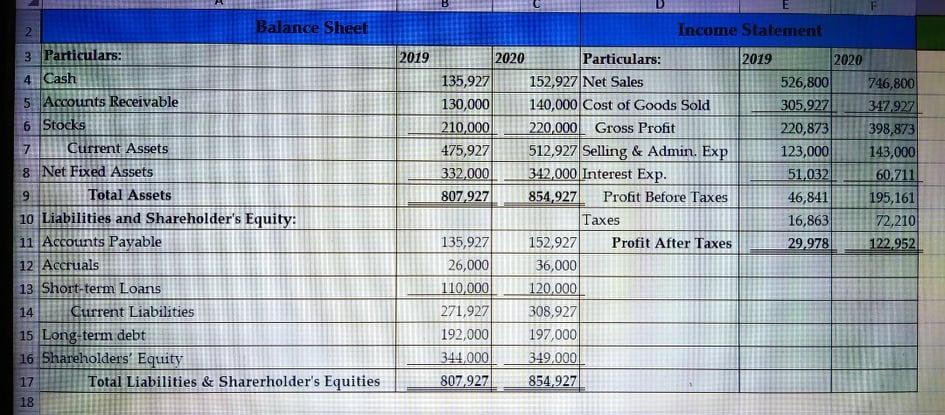

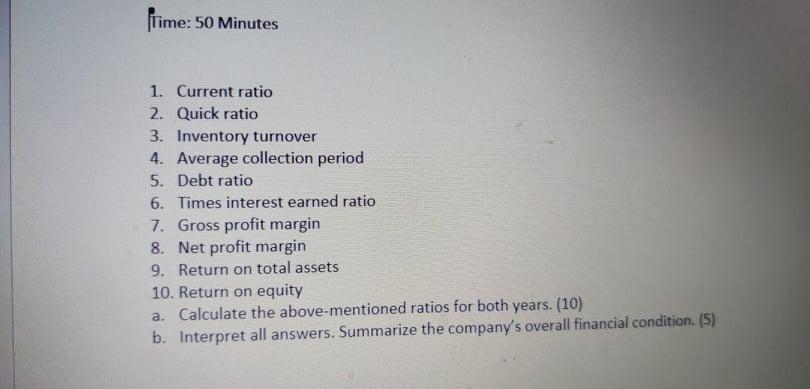

2 Balance Sheet Income Statement 3 Particulars: 4 Cash 5 Accounts Receivable 6 Stocks VD 7 Current Assets 8 Net Fixed Assets 9 Total Assets 10 Liabilities and Shareholder's Equity: 11 Accounts Payable 12 Accruals 13 Short-term Loans 14 Current Liabilities 15 Long-term debt 16 Shareholders' Equity 17 Total Liabilities & Sharerholder's Equities 18 2019 2020 Particulars: 2019 2020 135,927 152,927 Net Sales 526,800 746,800 130,000 140,000 Cost of Goods Sold 305.927 347.927 210,000 220,000 Gross Profit 220,873 398,873 475,927 512,927 Selling & Admin. Exp 123,000 143,000 332.000 342,000 Interest Exp. 51,032 60.711 807,927 854,927 Profit Before Taxes 46,841 195,161 Taxes 16,863 72,210 135,927 152,927 Profit After Taxes 29,978 122.952 26,000 36,000 110,000 120.000 271,927 308,927 192,000 197,000 344,000 349,000 807,927 854,927 Time: 50 Minutes 1. Current ratio 2. Quick ratio 3. Inventory turnover 4. Average collection period 5. Debt ratio 6. Times interest earned ratio 7. Gross profit margin 8. Net profit margin 9. Return on total assets 10. Return on equity a. Calculate the above-mentioned ratios for both years. (10) b. Interpret all answers. Summarize the company's overall financial condition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts