Question: Do Norwell and Sazabi Inc. problems, please show calculation thanks! ur3 tat 0asis equais its manufacturing cost of the 12,000 containers C)-0- D) None of

Do Norwell and Sazabi Inc. problems, please show calculation thanks!

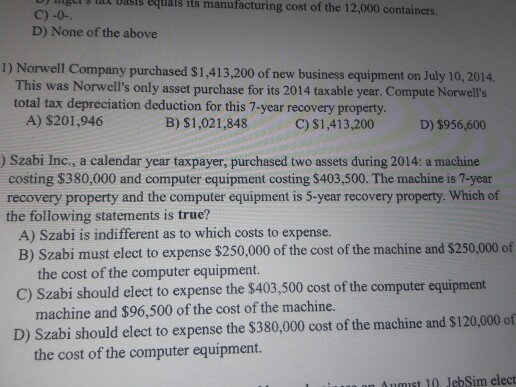

ur3 tat 0asis equais its manufacturing cost of the 12,000 containers C)-0- D) None of the above 1) Norwell Company purchased $1,413,200 of new business equipment on July 10, 2014 This was Norwell's only asset purchase for its 2014 taxable year. Compute Norwell's total tax depreciation deduction for this 7-year recovery property A) $201,946 B) $1,021,848 C) $1,413,200 D) $956,600 ) Szabi Inc., a calendar year taxpayer, purchased two assets during 2014: a machine costing $380,000 and computer equipment costing $403,500. The machine is 7-year recovery property and the computer equipment is 5-year recovery property. Which of the following statements is rue? A) Szabi is indifferent as to which costs to expense. B) Szabi must elect to expense $250,000 of the cost of the machine and $250,000 of C) Szabi should elect to expense the $403,500 cost of the computer equipment D) Szabi should elect to expense the $380,000 cost of the machine and $120,000 of the cost of the computer equipment. machine and $96,500 of the cost of the machine. the cost of the computer equipment. Aumust 10. JebSim elect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts