Question: Do not answer if you can't complete the requirements. SIMON COMPANY Simon Company is one of the major producers of generic and store brand hand

Do not answer if you can't complete the requirements.

Do not answer if you can't complete the requirements.

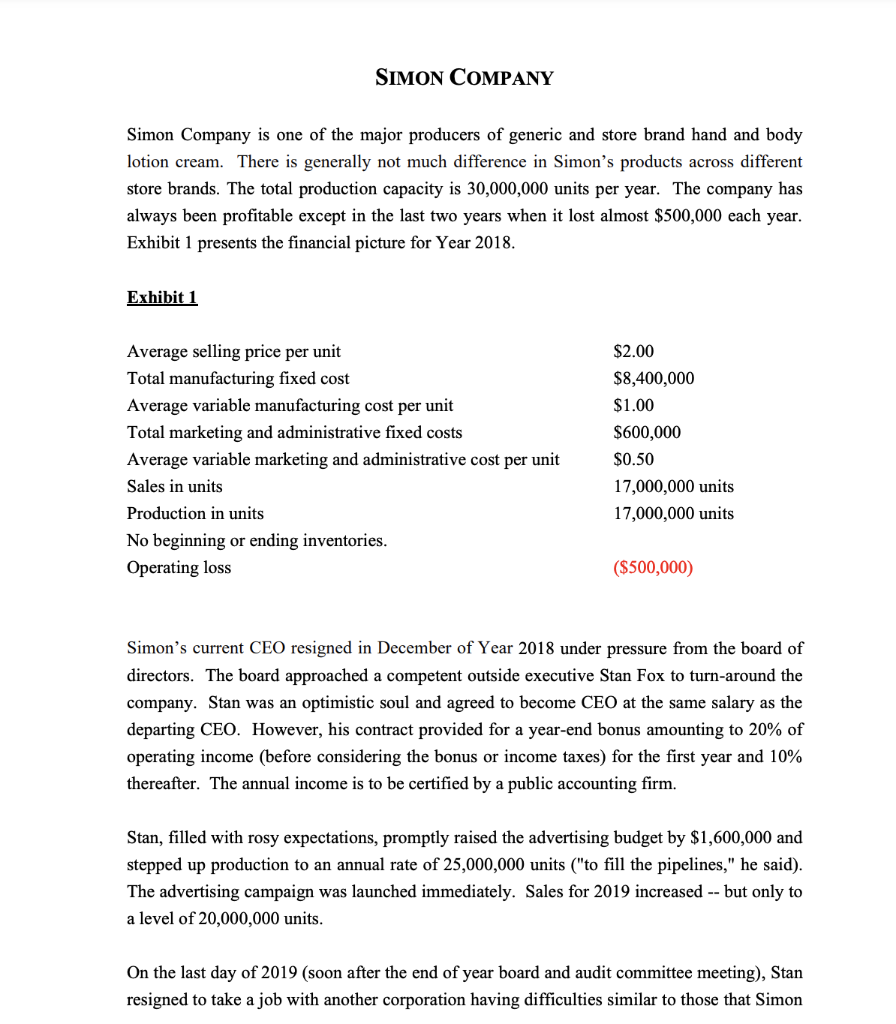

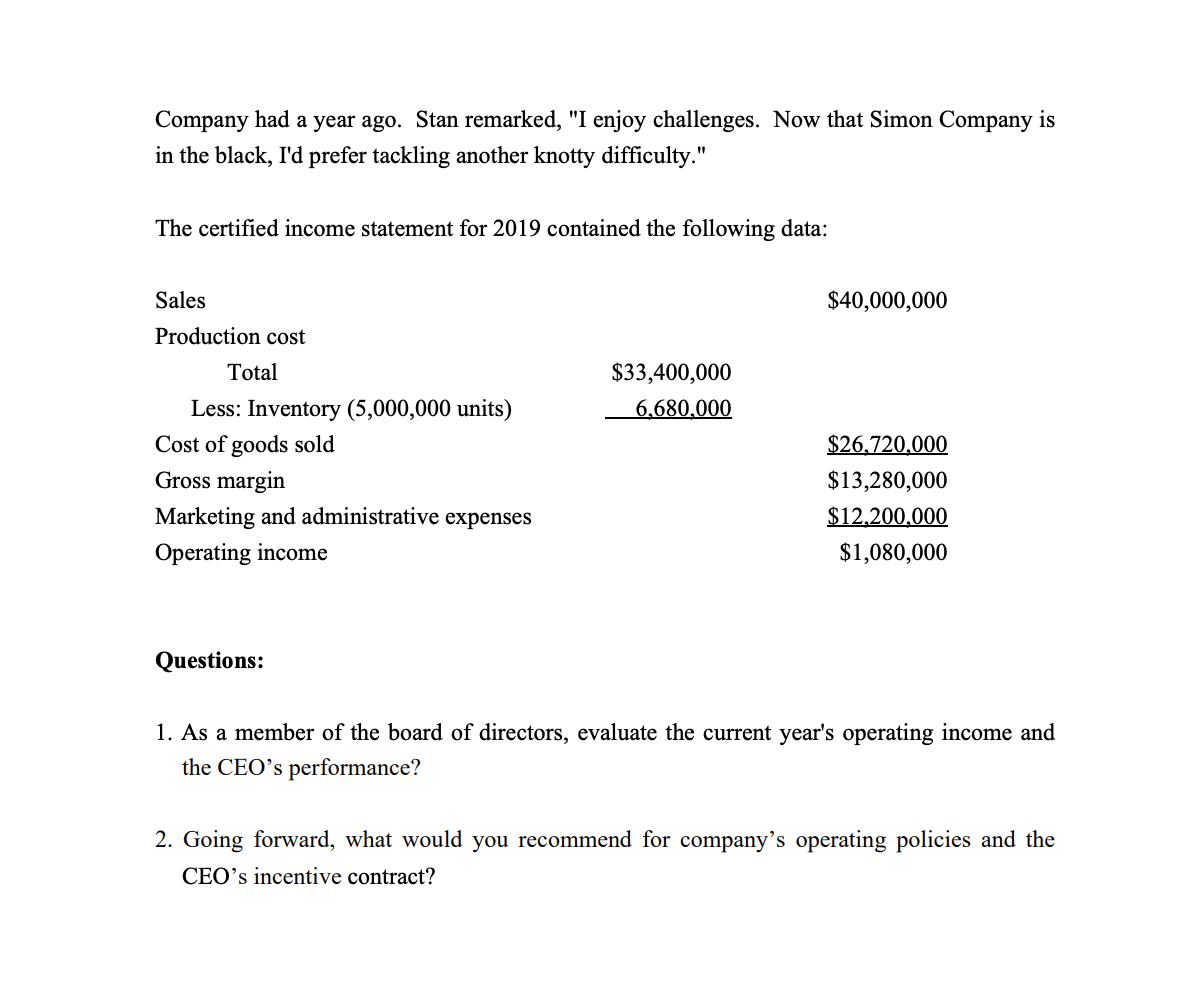

SIMON COMPANY Simon Company is one of the major producers of generic and store brand hand and body lotion cream. There is generally not much difference in Simon's products across different store brands. The total production capacity is 30,000,000 units per year. The company has always been profitable except in the last two years when it lost almost $500,000 each year. Exhibit 1 presents the financial picture for Year 2018. Exhibit 1 Average selling price per unit Total manufacturing fixed cost Average variable manufacturing cost per unit Total marketing and administrative fixed costs Average variable marketing and administrative cost per unit Sales in units Production in units No beginning or ending inventories. Operating loss $2.00 $8,400,000 $1.00 $600,000 $0.50 17,000,000 units 17,000,000 units ($500,000) Simon's current CEO resigned in December of Year 2018 under pressure from the board of directors. The board approached a competent outside executive Stan Fox to turn-around the company. Stan was an optimistic soul and agreed to become CEO at the same salary as the departing CEO. However, his contract provided for a year-end bonus amounting to 20% of operating income (before considering the bonus or income taxes) for the first year and 10% thereafter. The annual income is to be certified by a public accounting firm. Stan, filled with rosy expectations, promptly raised the advertising budget by $1,600,000 and stepped up production to an annual rate of 25,000,000 units ("to fill the pipelines," he said). The advertising campaign was launched immediately. Sales for 2019 increased -- but only to a level of 20,000,000 units. On the last day of 2019 (soon after the end of year board and audit committee meeting), Stan resigned to take a job with another corporation having difficulties similar to those that Simon Company had a year ago. Stan remarked, "I enjoy challenges. Now that Simon Company is in the black, I'd prefer tackling another knotty difficulty." The certified income statement for 2019 contained the following data: $40,000,000 Sales Production cost Total $33,400,000 6,680,000 Less: Inventory (5,000,000 units) Cost of goods sold Gross margin Marketing and administrative expenses Operating income $26.720,000 $13,280,000 $12,200,000 $1,080,000 Questions: 1. As a member of the board of directors, evaluate the current year's operating income and the CEO's performance? 2. Going forward, what would you recommend for company's operating policies and the CEO's incentive contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts