Question: DO NOT ANSWER ME IF U JUST COPY OTHERS PICS!!!!DO NOT WASTE MY QUESTIONS!!!THX!!! 3. (10 points) Today (at time t = 0) suppose that

DO NOT ANSWER ME IF U JUST COPY OTHERS" PICS!!!!DO NOT WASTE MY QUESTIONS!!!THX!!!

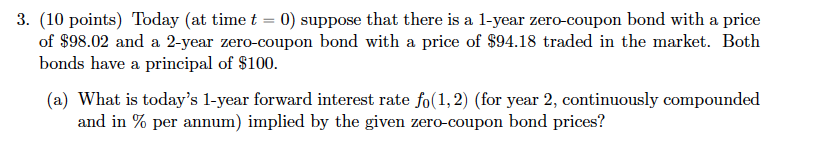

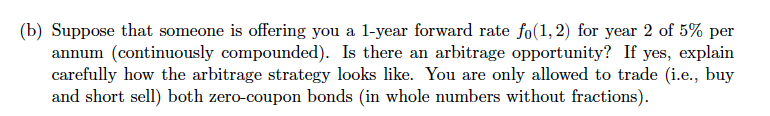

3. (10 points) Today (at time t = 0) suppose that there is a 1-year zero-coupon bond with a price of $98.02 and a 2-year zero-coupon bond with a price of $94.18 traded in the market. Both bonds have a principal of $100. (a) What is today's 1-year forward interest rate fo(1, 2) (for year 2, continuously compounded and in % per annum) implied by the given zero-coupon bond prices? (b) Suppose that someone is offering you a 1-year forward rate fo(1,2) for year 2 of 5% per annum (continuously compounded). Is there an arbitrage opportunity? If yes, explain carefully how the arbitrage strategy looks like. You are only allowed to trade i.e., buy and short sell) both zero-coupon bonds (in whole numbers without fractions). 3. (10 points) Today (at time t = 0) suppose that there is a 1-year zero-coupon bond with a price of $98.02 and a 2-year zero-coupon bond with a price of $94.18 traded in the market. Both bonds have a principal of $100. (a) What is today's 1-year forward interest rate fo(1, 2) (for year 2, continuously compounded and in % per annum) implied by the given zero-coupon bond prices? (b) Suppose that someone is offering you a 1-year forward rate fo(1,2) for year 2 of 5% per annum (continuously compounded). Is there an arbitrage opportunity? If yes, explain carefully how the arbitrage strategy looks like. You are only allowed to trade i.e., buy and short sell) both zero-coupon bonds (in whole numbers without fractions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts