Question: DO NOT ANSWER MY QUESTION IF YOU ARE NOT GOING TO ANSWER THE WHOLE THING!!!!!! LET SOMEONE ELSE DO IT! TF Olsen Outfitters Inc. believes

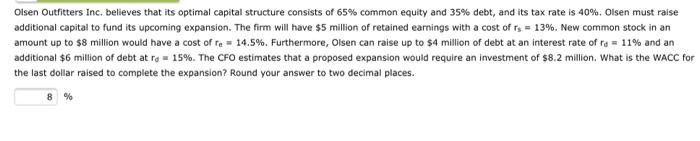

Olsen Outfitters Inc. believes that its optimal capital structure consists of 65% common equity and 35% debt, and its tax rate is 40%. Olsen must raise additional capital to fund its upcoming expansion. The firm will have $5 million of retained earnings with a cost of ts = 13%. New common stock in an amount up to $8 million would have a cost of re = 14.5%. Furthermore, Olsen can raise up to $4 million of debt at an interest rate of ra = 11% and an additional $6 million of debt at ro = 15%. The CFO estimates that a proposed expansion would require an investment of $8.2 million. What is the WACC for the last dollar raised to complete the expansion? Round your answer to two decimal places. 8 % Hook Industries's capital structure consists solely of debt and common equity. It can issue debt at ra = 10%, and its common stock currently pays a $3.7 dividend per share (Do = $3.75). The stock's price is currently $22.50, its dividend is expected to grow at a constant rate of 9% per year, its tax rate is 35%, and its WACC is 13.15%. What percentage of the company's capital structure consists of debt? Do not round intermediate calculations. Round your answer to two decimal places. 96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts