Question: DO NOT ANSWER THE SAME ANSWER GIVEN ALREADY. GIVE YOUR OWN ANSWER OR STAY AWAY FROM THE QUESTION!! 6. Assume that you will have 1

DO NOT ANSWER THE SAME ANSWER GIVEN ALREADY. GIVE YOUR OWN ANSWER OR STAY AWAY FROM THE QUESTION!!

DO NOT ANSWER THE SAME ANSWER GIVEN ALREADY. GIVE YOUR OWN ANSWER OR STAY AWAY FROM THE QUESTION!!

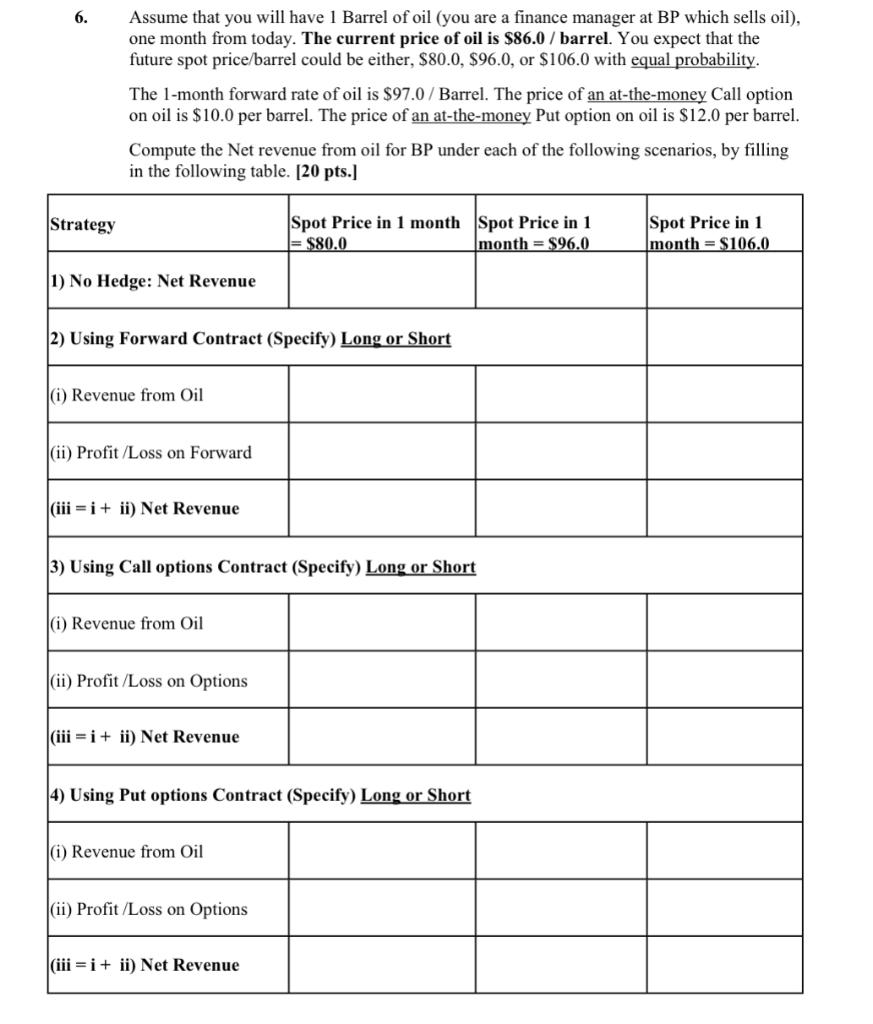

6. Assume that you will have 1 Barrel of oil (you are a finance manager at BP which sells oil), one month from today. The current price of oil is $86.0 / barrel. You expect that the future spot price/barrel could be either, $80.0, $96.0, or $106.0 with equal probability. The 1-month forward rate of oil is $97.0 /Barrel. The price of an at-the-money Call option on oil is $10.0 per barrel. The price of an at-the-money Put option on oil is $12.0 per barrel. Compute the Net revenue from oil for BP under each of the following scenarios, by filling in the following table. [20 pts.] Strategy Spot Price in 1 month Spot Price in 1 $80.0 month = $96.0 Spot Price in 1 month = $106.0 1) No Hedge: Net Revenue 2) Using Forward Contract (Specify) Long or Short (i) Revenue from Oil (ii) Profit/Loss on Forward (iii = i + ii) Net Revenue 3) Using Call options Contract (Specify) Long or Short (i) Revenue from Oil (ii) Profit/Loss on Options (iii = i + ii) Net Revenue 4) Using Put options Contract (Specify) Long or Short (i) Revenue from Oil (ii) Profit/Loss on Options (iii = i + ii) Net Revenue 6. Assume that you will have 1 Barrel of oil (you are a finance manager at BP which sells oil), one month from today. The current price of oil is $86.0 / barrel. You expect that the future spot price/barrel could be either, $80.0, $96.0, or $106.0 with equal probability. The 1-month forward rate of oil is $97.0 /Barrel. The price of an at-the-money Call option on oil is $10.0 per barrel. The price of an at-the-money Put option on oil is $12.0 per barrel. Compute the Net revenue from oil for BP under each of the following scenarios, by filling in the following table. [20 pts.] Strategy Spot Price in 1 month Spot Price in 1 $80.0 month = $96.0 Spot Price in 1 month = $106.0 1) No Hedge: Net Revenue 2) Using Forward Contract (Specify) Long or Short (i) Revenue from Oil (ii) Profit/Loss on Forward (iii = i + ii) Net Revenue 3) Using Call options Contract (Specify) Long or Short (i) Revenue from Oil (ii) Profit/Loss on Options (iii = i + ii) Net Revenue 4) Using Put options Contract (Specify) Long or Short (i) Revenue from Oil (ii) Profit/Loss on Options (iii = i + ii) Net Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts