Question: do not copy and paste from existing answers on this site. Many errors Bank J&D has the following assets and liabilities: Assets 1: 200 shares

do not copy and paste from existing answers on this site. Many errors

do not copy and paste from existing answers on this site. Many errors

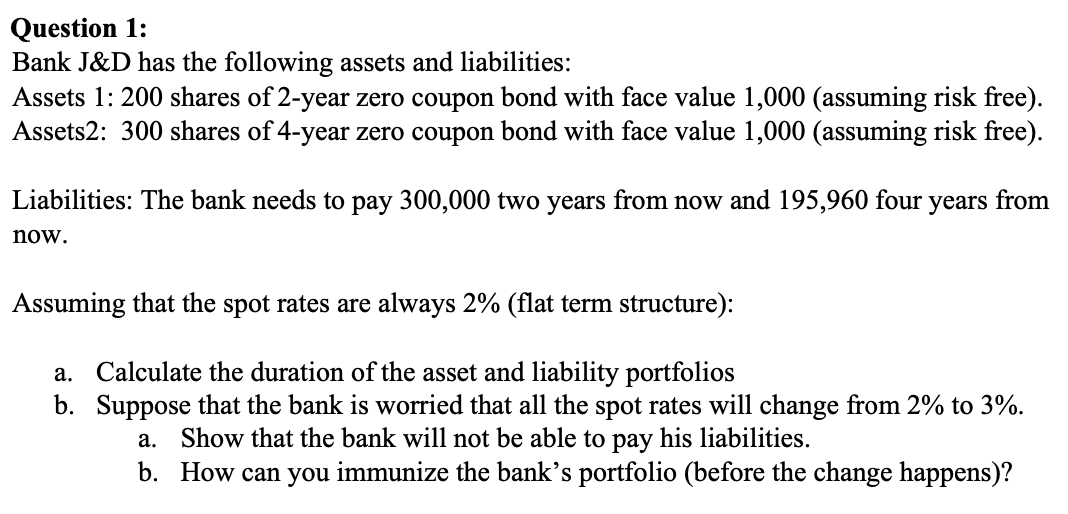

Bank J\&D has the following assets and liabilities: Assets 1: 200 shares of 2-year zero coupon bond with face value 1,000 (assuming risk free). Assets2: 300 shares of 4-year zero coupon bond with face value 1,000 (assuming risk free). Liabilities: The bank needs to pay 300,000 two years from now and 195,960 four years from now. Assuming that the spot rates are always 2% (flat term structure): a. Calculate the duration of the asset and liability portfolios b. Suppose that the bank is worried that all the spot rates will change from 2% to 3%. a. Show that the bank will not be able to pay his liabilities. b. How can you immunize the bank's portfolio (before the change happens)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts