Question: Do not copy and paste from previous answers available on this platform!! Suppose that the current price of one share of Facebook (FB) is $200.

Do not copy and paste from previous answers available on this platform!!

Do not copy and paste from previous answers available on this platform!!

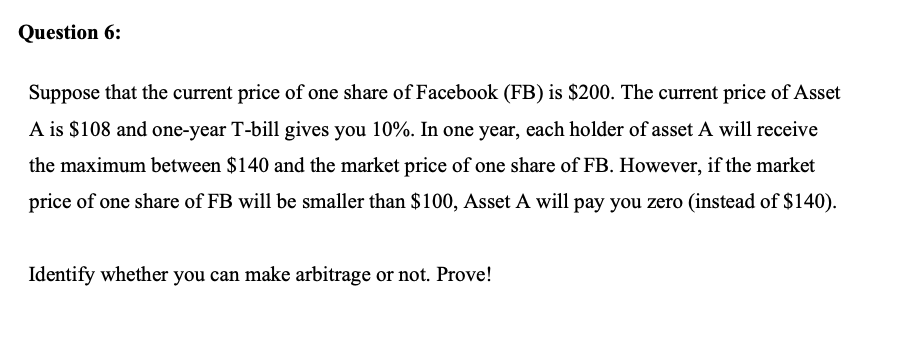

Suppose that the current price of one share of Facebook (FB) is $200. The current price of Asset A is $108 and one-year T-bill gives you 10%. In one year, each holder of asset A will receive the maximum between $140 and the market price of one share of FB. However, if the market price of one share of FB will be smaller than $100, Asset A will pay you zero (instead of $140 ). Identify whether you can make arbitrage or not. Prove! Suppose that the current price of one share of Facebook (FB) is $200. The current price of Asset A is $108 and one-year T-bill gives you 10%. In one year, each holder of asset A will receive the maximum between $140 and the market price of one share of FB. However, if the market price of one share of FB will be smaller than $100, Asset A will pay you zero (instead of $140 ). Identify whether you can make arbitrage or not. Prove

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts