Question: DO NOT COPY FROM CHEGG THE ANSWERS ARE WRONG THERE. PLEASE ATTEMPT THIS QUESTION ONLY IF YOU ARE 100 % SURE 4) The ECR Company

DO NOT COPY FROM CHEGG THE ANSWERS ARE WRONG THERE. PLEASE ATTEMPT THIS QUESTION ONLY IF YOU ARE 100 % SURE

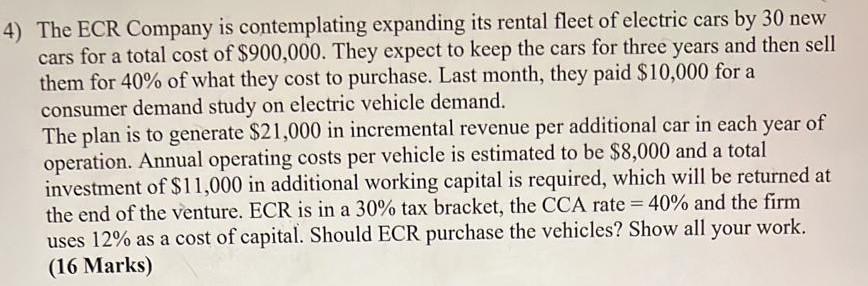

4) The ECR Company is contemplating expanding its rental fleet of electric cars by 30 new cars for a total cost of $900,000. They expect to keep the cars for three years and then sell them for 40% of what they cost to purchase. Last month, they paid $10,000 for a consumer demand study on electric vehicle demand. The plan is to generate $21,000 in incremental revenue per additional car in each year of operation. Annual operating costs per vehicle is estimated to be $8,000 and a total investment of $11,000 in additional working capital is required, which will be returned at the end of the venture. ECR is in a 30% tax bracket, the CCA rate = 40% and the firm uses 12% as a cost of capital. Should ECR purchase the vehicles? Show all your work. (16 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts