Question: Do not copy & paste someone else's answer to this question or I will dislike. Also please make sure your answer is legible and I

Do not copy & paste someone else's answer to this question or I will dislike. Also please make sure your answer is legible and I will like it.

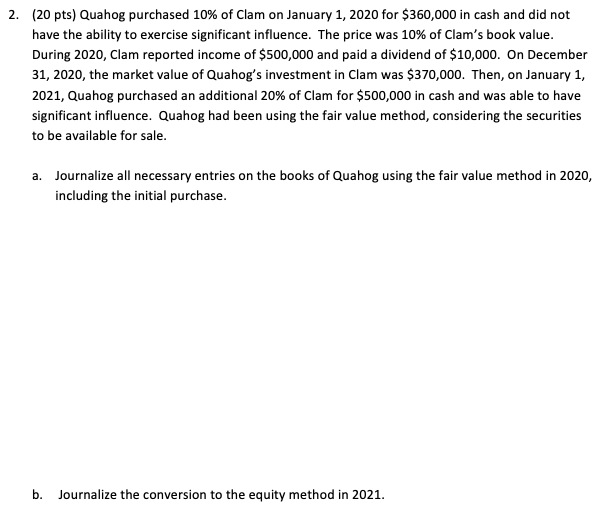

2. (20 pts) Quahog purchased 10% of Clam on January 1, 2020 for $360,000 in cash and did not have the ability to exercise significant influence. The price was 10% of Clam's book value. During 2020, Clam reported income of $500,000 and paid a dividend of $10,000. On December 31, 2020, the market value of Quahog's investment in Clam was $370,000. Then, on January 1, 2021, Quahog purchased an additional 20% of Clam for $500,000 in cash and was able to have significant influence. Quahog had been using the fair value method, considering the securities to be available for sale. a. Journalize all necessary entries on the books of Quahog using the fair value method in 2020, including the initial purchase. b. Journalize the conversion to the equity method in 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts