Question: Do not copy the old answer from chegg only answer q5 Imagine Country A has interest rates of 10% and Country B has interest rates

Do not copy the old answer from chegg

only answer q5

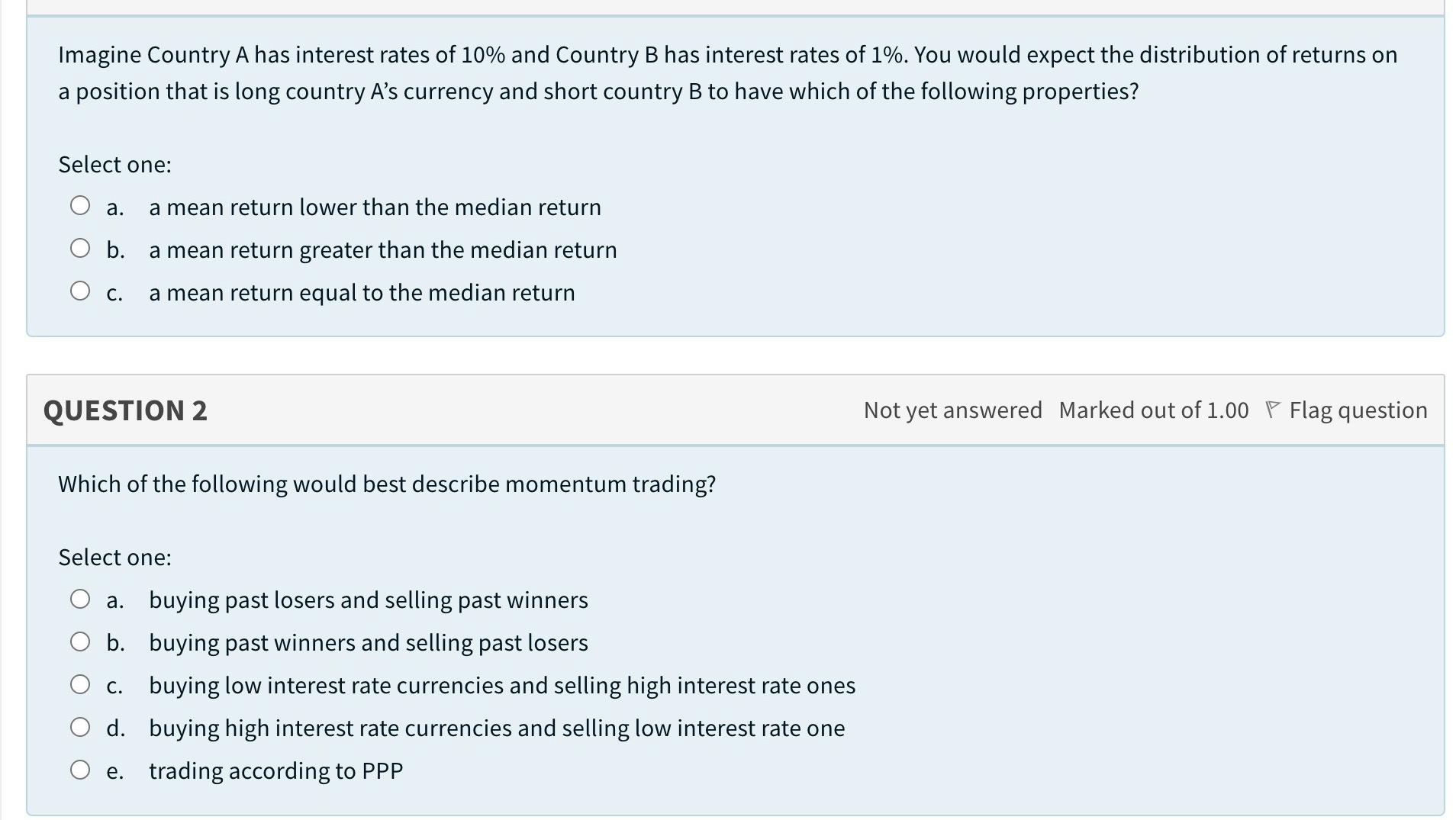

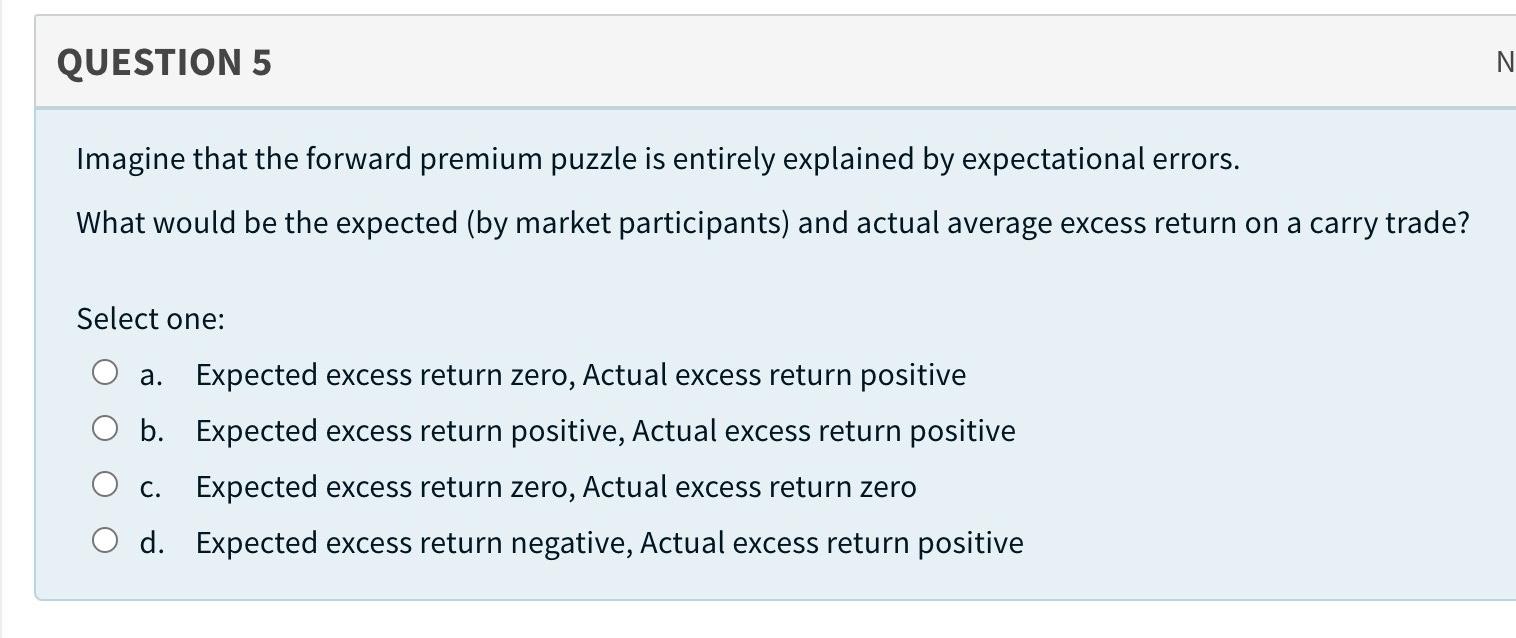

Imagine Country A has interest rates of 10% and Country B has interest rates of 1%. You would expect the distribution of returns on a position that is long country A's currency and short country B to have which of the following properties? Select one: a. a mean return lower than the median return b. a mean return greater than the median return a mean return equal to the median return C. QUESTION 2 Not yet answered Marked out of 1.00 P Flag question Which of the following would best describe momentum trading? Select one: a. buying past losers and selling past winners b. buying past winners and selling past losers C. buying low interest rate currencies and selling high interest rate ones d. buying high interest rate currencies and selling low interest rate one e. trading according to PPP QUESTION 5 N Imagine that the forward premium puzzle is entirely explained by expectational errors. What would be the expected (by market participants) and actual average excess return on a carry trade? Select one: a. Expected excess return zero, Actual excess return positive O b. Expected excess return positive, Actual excess return positive C. Expected excess return zero, Actual excess return zero d. Expected excess return negative, Actual excess return positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts