Question: do not do question 5 Q5-09 are related to the following information. - It is currently the beginning of 2023 . Cerpenate tax nate =20.

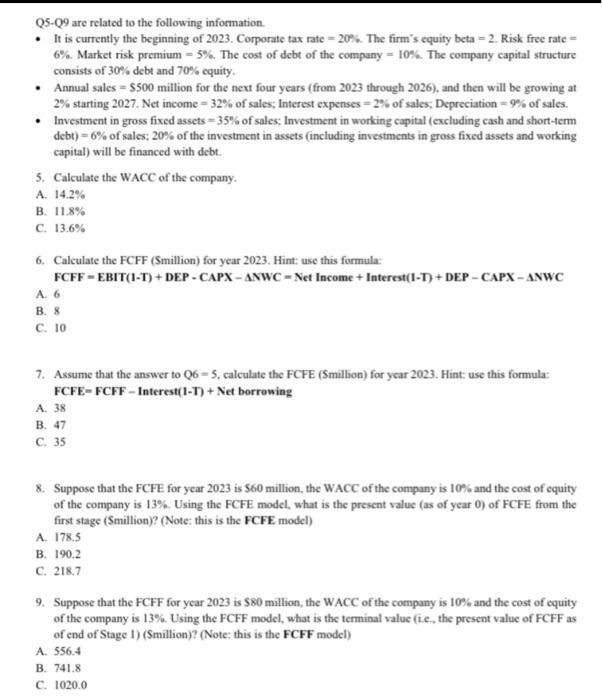

Q5-09 are related to the following information. - It is currently the beginning of 2023 . Cerpenate tax nate =20. The firm's equity leta 2. Risk free rate = 6%. Market riak premium 5%. The cost of debt of the cempany - 10\%:. The company capital structure consists of 307 . debt and 7ors equity. - Annual sales =5500 milhion for the neat four years (from 2023 throagh 2026), and then will be growing at 24. stanting 2027. Net incume = 325, of sales: leterest expenses - 24 s of sales: Depreciation =97 of sales. - Investment in gross fixed asscts 35% of sales levestment in working copital (eccluding cach and short-term dcbt)=6%. of sales; 20% of the investmsent in assts (inclating investments in gross fixed assets and working: capital) will be finunced with debe. 6. Calculate the FCFF (Smillion) for year 2023 . Hiat ane this formula: FCFF-E.BIT(1T)+DE.-CAPX-AVWC-NetIncome+Interest(1-T)+DE.P-CAPX-ANWC A. 6 B. 8 C. 10 7. Assume that the answer to Q6=5, calculate the FCFE (Smillion) fior year 2023, Hint use this formula: FCFE-FCFF - Interest (1T)+ Net berrening A. 38 B. 47 C. 35 8. Suppose that the FCFE for year 2023 is Ste million, the WACC of the compuny is 10N and the cost of equity of the company is 13\%. Using the FCFE modet, what is the present value (as of year 0) of FCFE from the fint stage (Smillion)? (Note: this is the FCFE model) A. 175 B. 190.2 C. 218.7 9. Suppose that the FCFF for ycar 2023 is 50 millinn, the WACC of the compuny is 10% and the cost of equity of the company is 13\%. Using the FCFF model. what is the terminal value (L.e. the present value of FCFF as of end of Stage 1) (Smillion)? (Note: this is the FCFF model) A. 556.4 B. 741.8 C. 1020.0 Q5-Q9 are related to the following information. - It is currently the beginning of 2023 . Corporate tax rate =20%. The firm's equity beta =2. Risk free rate = 6%. Market risk premium =5%. The cost of debt of the company =10%. The company capital structure consists of 30% debt and 70% equity. - Annual sales = $500 million for the next four years (from 2023 through 2026), and then will be growing at 2% starting 2027. Net income =32% of sales; Interest expenses =2% of sales; Depreciation =9% of sales. - Investment in gross fixed assets =35% of sales; Investment in working capital (excluding cash and short-term debt)=6% of sales; 20% of the investment in assets (including investments in gross fixed assets and working capital) will be financed with debt. 5. Calculate the WACC of the company. A. 14.2% B. 11.8% C. 13.6% 6. Calculate the FCFF (Smillion) for year 2023. Hint: use this formula: FCFF=EBIT(1T)+DEPCAPXANWC=NetIncome+Interest(1T)+DEPCAPXANWC A. 6 B. 8 C. 10 7. Assume that the answer to Q= 5, calculate the FCFE (Smillion) for year 2023. Hint: use this formula: FCFE-FCFF - Interest(1-T) + Net borrowing A. 38 B. 47 C. 35 8. Suppose that the FCFE for year 2023 is $60 million, the WACC of the company is 10% and the cost of equity of the company is 13%. Using the FCFE model, what is the present value (as of year 0 ) of FCFE from the first stage (Smillion)? (Note: this is the FCFE model) A. 178.5 B. 190.2 C. 218.7 9. Suppose that the FCFF for year 2023 is $80 million, the WACC of the company is 10% and the cost of equity of the company is 13%. Using the FCFF model, what is the terminal value (i.e, the present value of FCFF as of end of Stage 1) (Smillion)? (Note: this is the FCFF model) A. 556.4 B. 741.8 C. 1020.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts