Question: Do not know how to work through this problem from my practice exam. As you can see right answer is highlighted I just need someone

Do not know how to work through this problem from my practice exam. As you can see right answer is highlighted I just need someone to SHOW ALL WORK involved with this problem. Thank you !

!

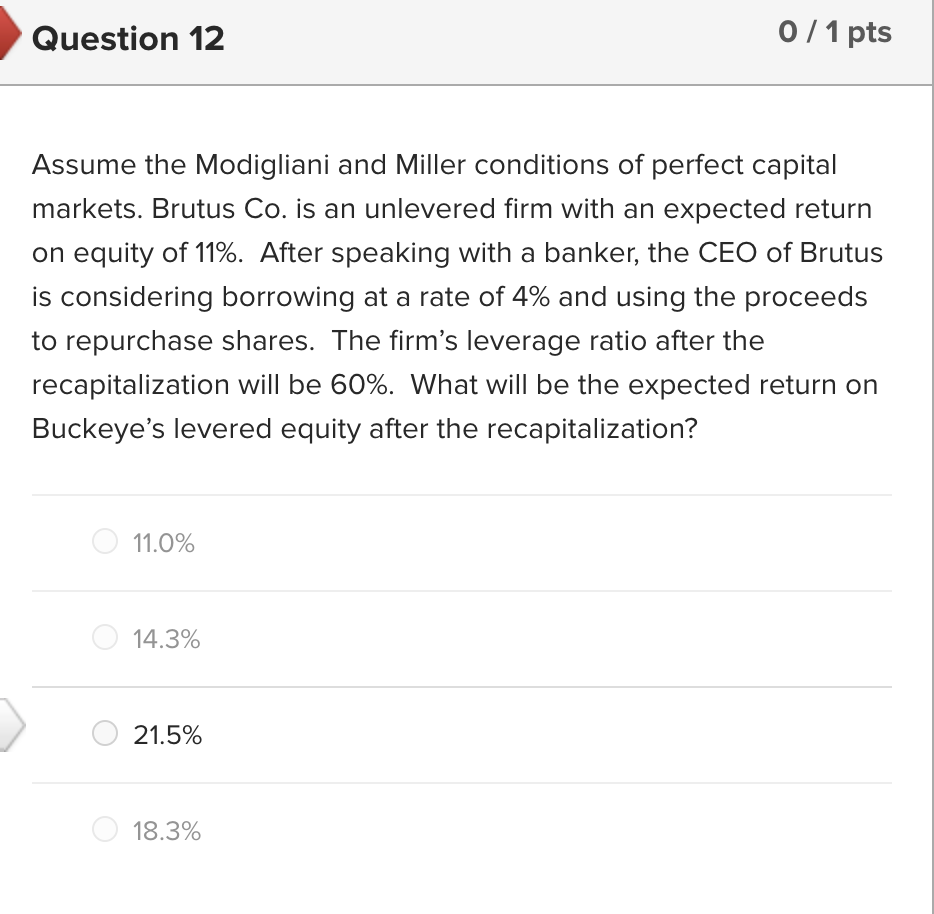

Question 12 0 / 1 pts Assume the Modigliani and Miller conditions of perfect capital markets. Brutus Co. is an unlevered firm with an expected return on equity of 11%. After speaking with a banker, the CEO of Brutus is considering borrowing at a rate of 4% and using the proceeds to repurchase shares. The firm's leverage ratio after the recapitalization will be 60%. What will be the expected return on Buckeye's levered equity after the recapitalization? 11.0% 14.3% 21.5% 18.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts