Question: Do not need to answer part 1 in this, as the excess reserve is 2,052,000. Just need part 2 & 3 answered. Question 1: The

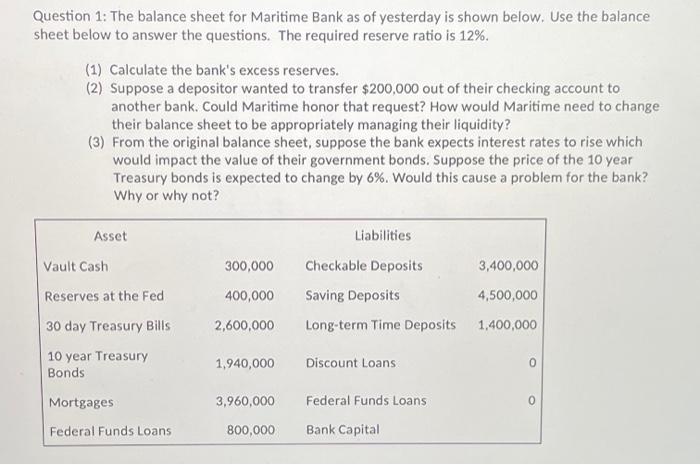

Question 1: The balance sheet for Maritime Bank as of yesterday is shown below. Use the balance sheet below to answer the questions. The required reserve ratio is 12%. (1) Calculate the bank's excess reserves. (2) Suppose a depositor wanted to transfer $200,000 out of their checking account to another bank. Could Maritime honor that request? How would Maritime need to change their balance sheet to be appropriately managing their liquidity? (3) From the original balance sheet, suppose the bank expects interest rates to rise which would impact the value of their government bonds. Suppose the price of the 10 year Treasury bonds is expected to change by 6% Would this cause a problem for the bank? Why or why not? Asset Liabilities Vault Cash 300,000 3,400,000 400,000 Checkable Deposits Saving Deposits Long-term Time Deposits Reserves at the Fed 30 day Treasury Bills 4,500,000 2,600,000 1,400,000 10 year Treasury Bonds 1,940,000 Discount Loans 0 3,960,000 0 Mortgages Federal Funds Loans Federal Funds Loans Bank Capital 800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts