Question: do NOT prepare acquisition-date fair value schedule 1. Prepare a list of consolidation entries 2. Determining the consolidated totals The Peregrine Corporation acquired 80 percent

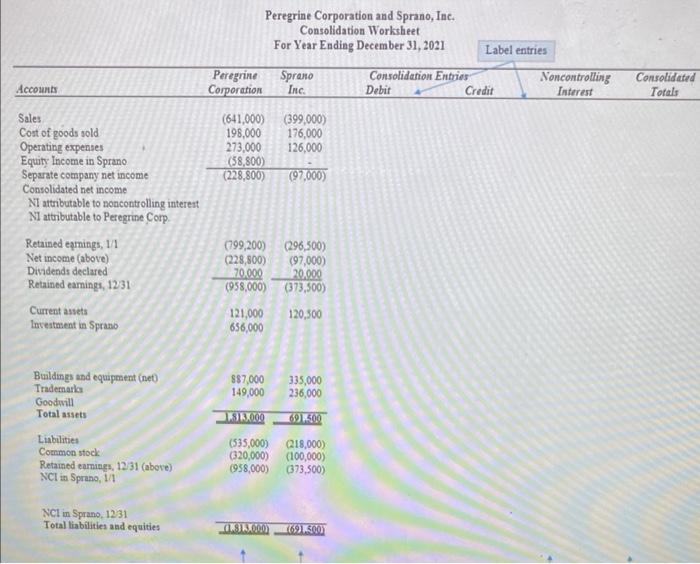

The Peregrine Corporation acquired 80 percent of the 100,000 outstanding voting shares of Sprano, Inc, for $7.20 per share on January 1, 2020. The remaining 20 percent of Sprano's shares traded actively at $4.76 per share before and after Peregrine's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Sprano's underlying accounts except that a building with a 5 -year future life was undervalued (i.e, book value is lower than fair value) by $85,500 and a fully amortized trademark (i.e, zero book value) with an estimated 10-year remaining life had a $64,000 fair value. At the acquisition date, Sprano reported common stock of $100,000 and a retained earnings balance of $226,500. Following are the separate financial statements for the year ending December 31,2021 : 3. (32 points) Use the provided worksheet (in Excel) to consolidate these two companies as of December 31, 2021 and do the following: - (20 points) Prepare a list of consolidation entries - (12 points) Determining the consolidated totals Peregrine Corporation and Sprano, Inc. Consolidation Worksheet For Year Ending December 31, 2021 The Peregrine Corporation acquired 80 percent of the 100,000 outstanding voting shares of Sprano, Inc, for $7.20 per share on January 1, 2020. The remaining 20 percent of Sprano's shares traded actively at $4.76 per share before and after Peregrine's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Sprano's underlying accounts except that a building with a 5 -year future life was undervalued (i.e, book value is lower than fair value) by $85,500 and a fully amortized trademark (i.e, zero book value) with an estimated 10-year remaining life had a $64,000 fair value. At the acquisition date, Sprano reported common stock of $100,000 and a retained earnings balance of $226,500. Following are the separate financial statements for the year ending December 31,2021 : 3. (32 points) Use the provided worksheet (in Excel) to consolidate these two companies as of December 31, 2021 and do the following: - (20 points) Prepare a list of consolidation entries - (12 points) Determining the consolidated totals Peregrine Corporation and Sprano, Inc. Consolidation Worksheet For Year Ending December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts