Question: ***DO NOT REPLY IF YOU'RE NOT GOING TO DO THEM ALL *** Consider the following three bond quotes: a Treasury note quoted at 96:30, a

***DO NOT REPLY IF YOU'RE NOT GOING TO DO THEM ALL ***

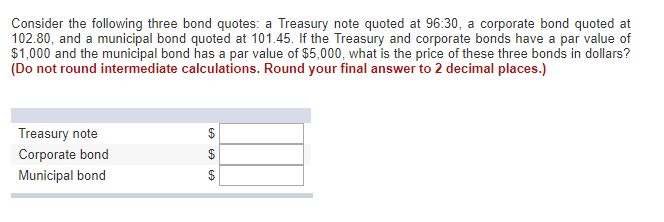

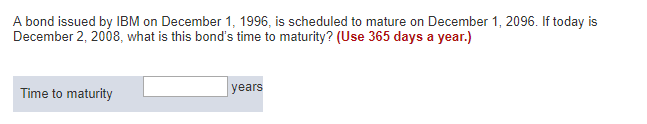

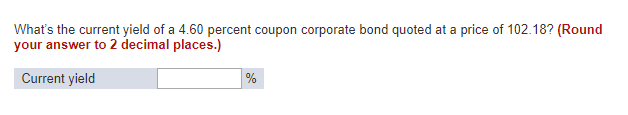

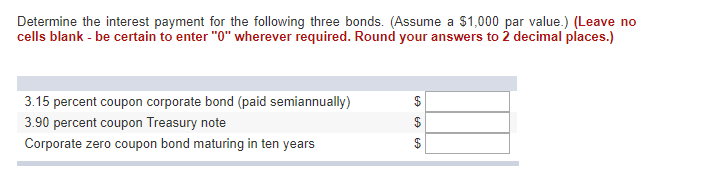

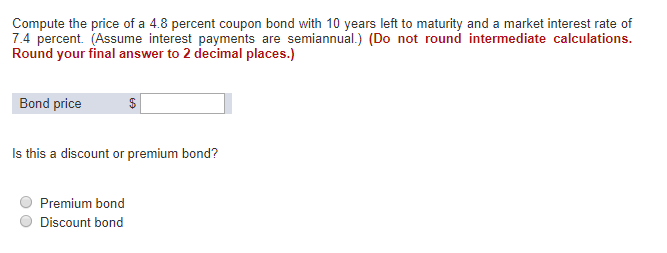

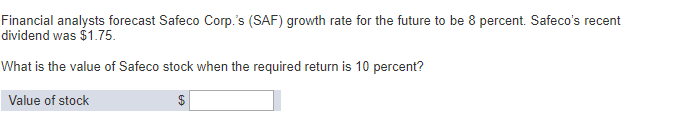

Consider the following three bond quotes: a Treasury note quoted at 96:30, a corporate bond quoted at 102.80, and a municipal bond quoted at 101.45. If the Treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Treasury note Corporate bond Municipal bond A bond issued by IBM on December 1, 1996, is scheduled to mature on December 1, 2096. If today is December 2, 2008, what is this bond's time to maturity? (Use 365 days a year.) years Time to maturity What's the current yield of a 4.60 percent coupon corporate bond quoted at a price of 102.18? (Round your answer to 2 decimal places.) Current yield Determine the interest payment for the following three bonds. (Assume a $1,000 par value.) (Leave no cells blank - be certain to enter "0" wherever required. Round your answers to 2 decimal places.) 3.15 percent coupon corporate bond (paid semiannually) 3.90 percent coupon Treasury note Corporate zero coupon bond maturing in ten years Compute the price of a 4.8 percent coupon bond with 10 years left to maturity and a market interest rate of 7.4 percent. (Assume interest payments are semiannual.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Bond price Is this a discount or premium bond? Premium bond Discount bond Financial analysts forecast Safeco Corp.'s (SAF) growth rate for the future to be 8 percent. Safeco's recent dividend was $1.75. What is the value of Safeco stock when the required return is 10 percent? Value of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts