Question: do not undertstant how to do this question Assume that a firm currently has a debt-to-equity ratio of o, a Net Income of 1.1 million

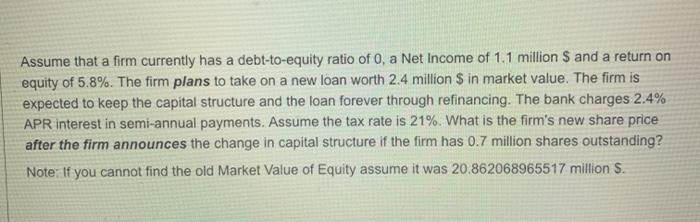

Assume that a firm currently has a debt-to-equity ratio of o, a Net Income of 1.1 million $ and a return on equity of 5.8%. The firm plans to take on a new loan worth 2.4 million $ in market value. The firm is expected to keep the capital structure and the loan forever through refinancing. The bank charges 2.4% APR interest in semi-annual payments. Assume the tax rate is 21%. What is the firm's new share price after the firm announces the change in capital structure if the firm has 0.7 million shares outstanding? Note: If you cannot find the old Market Value of Equity assume it was 20.862068965517 million $. Assume that a firm currently has a debt-to-equity ratio of o, a Net Income of 1.1 million $ and a return on equity of 5.8%. The firm plans to take on a new loan worth 2.4 million $ in market value. The firm is expected to keep the capital structure and the loan forever through refinancing. The bank charges 2.4% APR interest in semi-annual payments. Assume the tax rate is 21%. What is the firm's new share price after the firm announces the change in capital structure if the firm has 0.7 million shares outstanding? Note: If you cannot find the old Market Value of Equity assume it was 20.862068965517 million $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts