Question: Do not use any spread sheets you can solve any problem youd like. i rate all the time please show work CHOOSING AMONG INVESTMENT ALTERNATIVES

Do not use any spread sheets you can solve any problem youd like. i rate all the time please show work

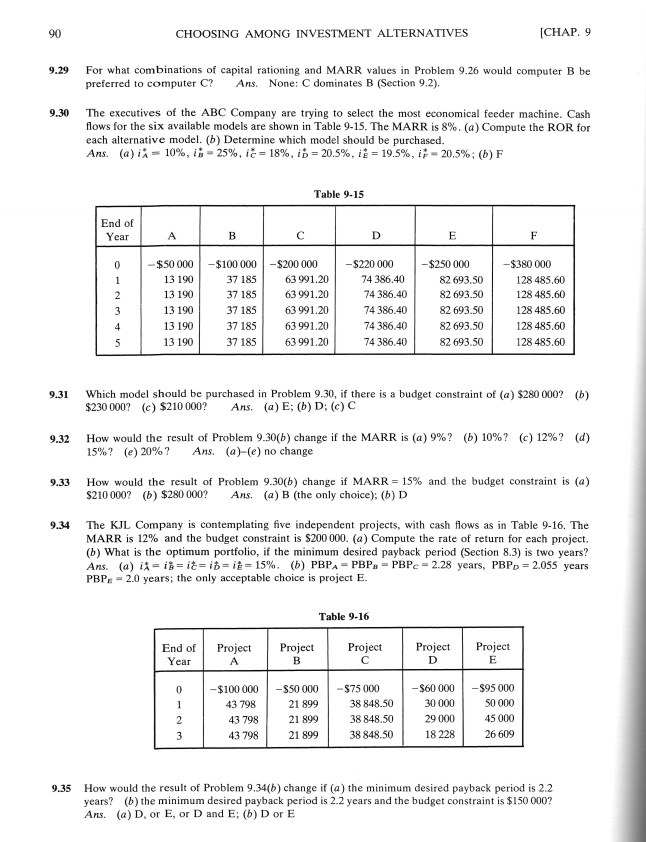

CHOOSING AMONG INVESTMENT ALTERNATIVES CHAP. 9 9.29 For what combinations of capital rationing and MARR values in Problem 9.26 would computer B be preferred to computer ? Ans. None: C dominates B (Section 9.2). The executives of the ABC Company are trying to select the most economical feeder machine. Cash flows for the six available models are shown in Table 9-15. The MARR is 8%, (a) Compute the ROR for each alternative model. (b) Determine which model should be purchased. Ans. (a)/A-10%, ii-25%, i8-18%, i = 20.5%,= 19.5%,-20.5%; (b) F 9.30 Table 9-15 End of Ycar 0$50000$100 000$200000 $220000-$250 000 -$380 000 13 190 13 190 13 190 13 190 13 190 37 185 37 185 37 185 37 185 63991.20 37 185 63991.20 63 991.20 63991.20 74 386.40 74 386.40 74 386.40 74 386.40 74 386.40 82 693.50 82 693.50 82 693.50 82 693.50 82 693.50 128 485.60 128 485.60 128 485.60 128 485.60 128 485.60 63 991.20 Which model should be purchased in Problem 9.30, if there is a budget constraint of (a) $280 000? (b) $230 000? 9.31 (c) $210 000? Ans. (a) E; (b) D; (c) C (b) 1096? (c) 12%? (d) How would the result of Problem 9.30(b) change if the MARR is (a) 9%? 15%? 9.32 (e) 2006? Ans. (a)-(e) no change How would the result of Problem 9.30(b) change if MARR= 15% and the budget constraint is (a) $210 000? (b) $280 000? 9.33 Ans. (a) B (the only choice); (b) D The KJL Company is contemplating five independent projects, with cash flows as in Table 9-16. The MARR is 12% and the budget constraint is $200000. (a) Compute the rate of return for each project. (b) What is the optimum portfolio, if the minimum desired payback period (Section 8.3) is two years? Ans. (a) i%= is-=== 15%. (b) PBPa= PBPB=PBPe= 2.28 years, PBPD=2.055 years PBP-2.0 years; the only acceptable choice is project E 9.34 Table 9-16 End of Project Project Project Projec Project -$60 000$95 000 50000 45 000 26 609 -$100 000S50 000$75 000 43 798 43 798 43 798 21 899 21 899 21 899 38 848.50 38 848.50 38 848.50 30 000 29 000 18 228 How would the result of Problem 9.34(b) change if (a) the minimum desired payback period is 2.2 years? (b) the minimum desired payback period is 2.2 years and the budget constraint is $150 000? Ans. (a) D, or E, or D and E; (b) D or E 9.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts