Question: DO NOT USE CHATGBT PLEASE. IF YOU DO PLEASE SKIP THIS BECAUSE YOU GET IT WRONG MORE TIMES THAN RIGHT. THANK YOU Liquidating Partnerships Prior

DO NOT USE CHATGBT PLEASE. IF YOU DO PLEASE SKIP THIS BECAUSE YOU GET IT WRONG MORE TIMES THAN RIGHT. THANK YOU

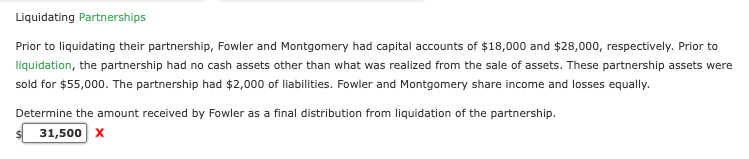

Liquidating Partnerships Prior to liquidating their partnership, Fowler and Montgomery had capital accounts of $18,000 and $28,000, respectively. Prior to liquidation, the partnership had no cash assets other than what was realized from the sale of assets. These partnership assets were sold for $55,000. The partnership had $2,000 of liabilities. Fowler and Montgomery share income and losses equally. Determine the amount received by Fowler as a final distribution from liquidation of the partnership. x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts