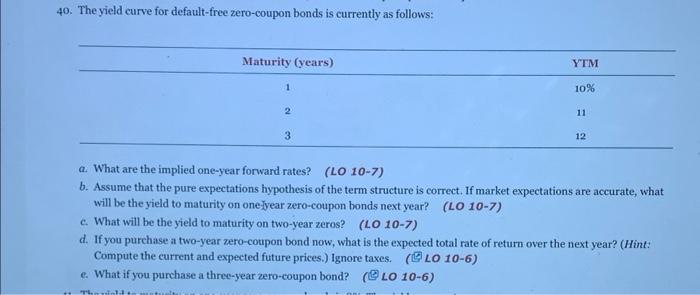

Question: do NOT use excel 40. The yield curve for default-free zero-coupon bonds is currently as follows: Maturity (years) YTM 1 10% 2 11 3 12

40. The yield curve for default-free zero-coupon bonds is currently as follows: Maturity (years) YTM 1 10% 2 11 3 12 a. What are the implied one-year forward rates? (LO 10-7) b. Assume that the pure expectations hypothesis of the term structure is correct. If market expectations are accurate, what will be the yield to maturity on one year zero-coupon bonds next year? (LO 10-7) e. What will be the yield to maturity on two-year zeros? (LO 10-7) d. If you purchase a two-year zero-coupon bond now, what is the expected total rate of return over the next year? (Hint: Compute the current and expected future prices.) Ignore taxes. (@LO 10-6) e. What if you purchase a three-year zero-coupon bond? (@LO 10-6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts