Question: DO NOT USE EXCEL. Please show step by step. Problem 4 (15 points): Assume the term structure of interest rates is flat and consider a

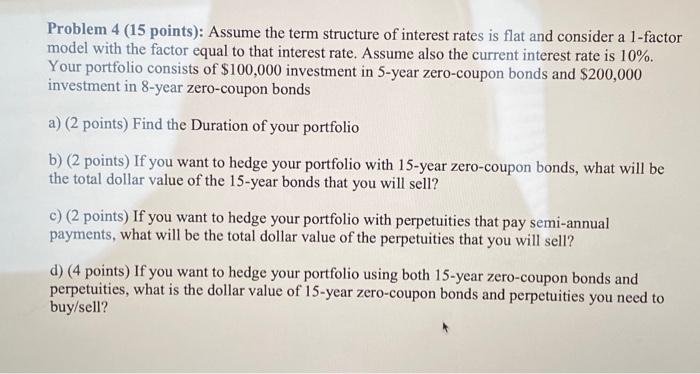

Problem 4 (15 points): Assume the term structure of interest rates is flat and consider a 1-factor model with the factor equal to that interest rate. Assume also the current interest rate is 10%. Your portfolio consists of $100,000 investment in 5-year zero-coupon bonds and $200,000 investment in 8-year zero-coupon bonds a) (2 points) Find the Duration of your portfolio b) (2 points) If you want to hedge your portfolio with 15-year zero-coupon bonds, what will be the total dollar value of the 15-year bonds that you will sell? c) (2 points) If you want to hedge your portfolio with perpetuities that pay semi-annual payments, what will be the total dollar value of the perpetuities that you will sell? d) (4 points) If you want to hedge your portfolio using both 15-year zero-coupon bonds and perpetuities, what is the dollar value of 15-year zero-coupon bonds and perpetuities you need to buy/sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts