Question: do not use excel. plz show work Question 3 You are interested in buying shares of Tesla, but the stock was very volatile lately and

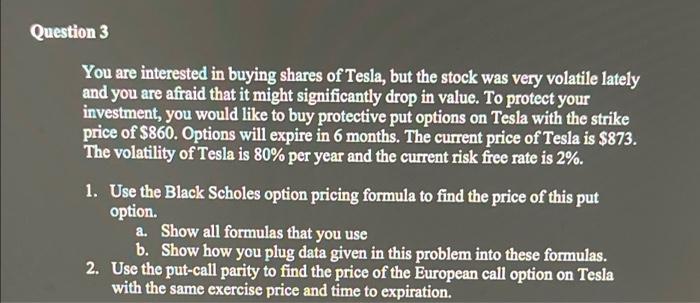

Question 3 You are interested in buying shares of Tesla, but the stock was very volatile lately and you are afraid that it might significantly drop in value. To protect your investment, you would like to buy protective put options on Tesla with the strike price of $860. Options will expire in 6 months. The current price of Tesla is $873. The volatility of Tesla is 80% per year and the current risk free rate is 2%. 1. Use the Black Scholes option pricing formula to find the price of this put option. a. Show all formulas that you use b. Show how you plug data given in this problem into these formulas. 2. Use the put-call parity to find the price of the European call option on Tesla with the same exercise price and time to expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts