Question: Do not use excel to do it! A firm is considering two alternatives that have no salvage value. At the end of 4 years, another

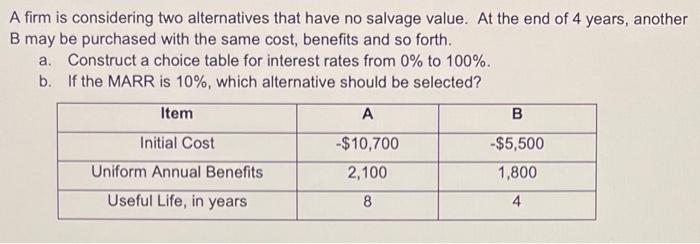

A firm is considering two alternatives that have no salvage value. At the end of 4 years, another B may be purchased with the same cost, benefits and so forth. a. Construct a choice table for interest rates from 0% to 100%. b. If the MARR is 10%, which alternative should be selected? Item A B Initial Cost Uniform Annual Benefits Useful Life, in years -$10,700 2,100 -$5,500 1,800 8 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts