Question: Do not use Excel to solve it, please solve as the problem asks. The second image apperantly is not answered as the problem asks. I'm

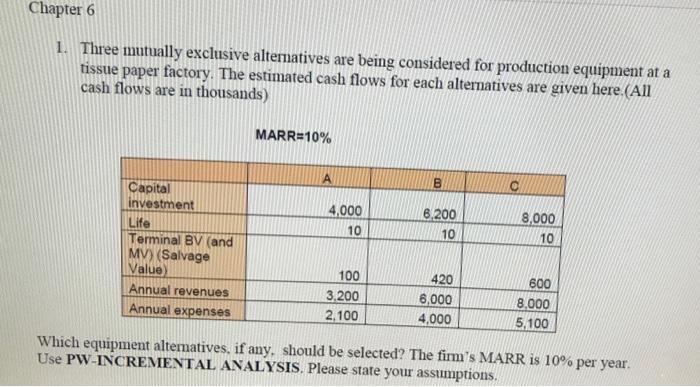

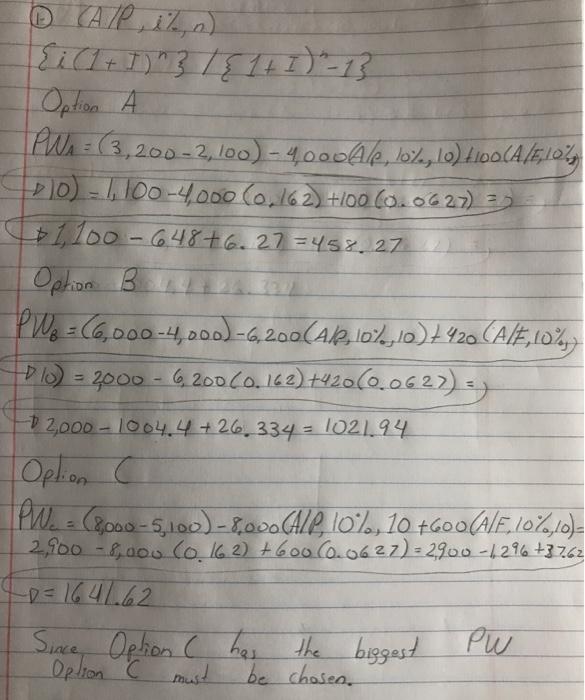

Chapter 6 1. Three mutually exclusive alternatives are being considered for production equipment at a tissue paper factory. The estimated cash flows for each alternatives are given here.(All cash flows are in thousands) MARR=10% A B 4,000 10 6.200 10 8,000 10 Capital Investment Life Terminal BV (and MV) (Salvage Value) Annual revenues Annual expenses 100 3.200 2.100 420 6,000 4,000 600 8.000 5,100 Which equipment altematives, if any, should be selected? The firm's MARR is 10% per year. Use PW-INCREMENTAL ANALYSIS. Please state your assumptions. DAL, 1%, o) PWA: (3,200-2,100) -40004, 10%, Lo) 100(A/1,102 ]0) - 1, 100-4,000 (0.162) +100 (0.0627) 1,100-64876.27=452.27 Option Bil.33% PWo=C6,000-4,000) -6,200(Ak, 10%,0) +420 (Al},10%) + 3) = 2000 - 6.200(0.162) +42000.0622) D 2,000 -1004.4+26.334 - 1021.94 Option C W = (8000-5,100) -8.00. All 10%, 10.4600(ALE, 10%,0)= 2,900 - 8,000 (0.162) +600 (0.0627) = 2900 -1,296 +3762 40= 1641.62 Since Ophion C has the biggest PW Option C must be choses. Chapter 6 1. Three mutually exclusive alternatives are being considered for production equipment at a tissue paper factory. The estimated cash flows for each alternatives are given here.(All cash flows are in thousands) MARR=10% A B 4,000 10 6.200 10 8,000 10 Capital Investment Life Terminal BV (and MV) (Salvage Value) Annual revenues Annual expenses 100 3.200 2.100 420 6,000 4,000 600 8.000 5,100 Which equipment altematives, if any, should be selected? The firm's MARR is 10% per year. Use PW-INCREMENTAL ANALYSIS. Please state your assumptions. DAL, 1%, o) PWA: (3,200-2,100) -40004, 10%, Lo) 100(A/1,102 ]0) - 1, 100-4,000 (0.162) +100 (0.0627) 1,100-64876.27=452.27 Option Bil.33% PWo=C6,000-4,000) -6,200(Ak, 10%,0) +420 (Al},10%) + 3) = 2000 - 6.200(0.162) +42000.0622) D 2,000 -1004.4+26.334 - 1021.94 Option C W = (8000-5,100) -8.00. All 10%, 10.4600(ALE, 10%,0)= 2,900 - 8,000 (0.162) +600 (0.0627) = 2900 -1,296 +3762 40= 1641.62 Since Ophion C has the biggest PW Option C must be choses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts