Question: do not write with handwriting 7) Gulf, Inc. has issued a $1,000 par 4% annual coupon bond that is to mature in 10 years. If

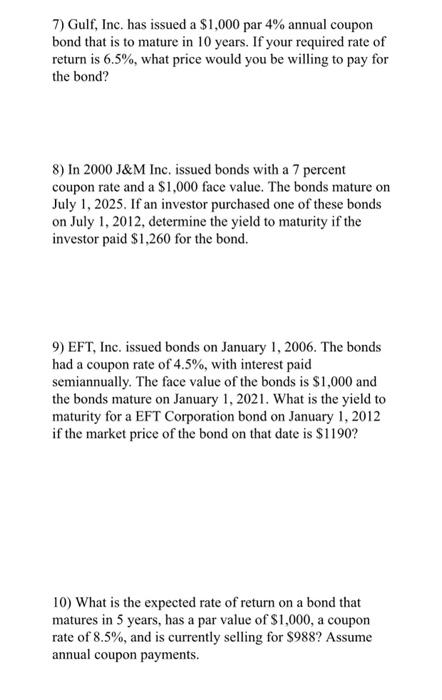

7) Gulf, Inc. has issued a $1,000 par 4% annual coupon bond that is to mature in 10 years. If your required rate of return is 6.5%, what price would you be willing to pay for the bond? 8) In 2000 J&M Inc. issued bonds with a 7 percent coupon rate and a $1,000 face value. The bonds mature on July 1, 2025. If an investor purchased one of these bonds on July 1, 2012, determine the yield to maturity if the investor paid $1,260 for the bond. 9) EFT, Inc. issued bonds on January 1, 2006. The bonds had a coupon rate of 4.5%, with interest paid semiannually. The face value of the bonds is $1,000 and the bonds mature on January 1, 2021. What is the yield to maturity for a EFT Corporation bond on January 1, 2012 if the market price of the bond on that date is $1190? 10) What is the expected rate of return on a bond that matures in 5 years, has a par value of $1,000, a coupon rate of 8.5%, and is currently selling for $988? Assume annual coupon payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts