Question: do only part 2 for this first one and finish the other please! At the end of its first year of operation, Splish Brothers Inc.

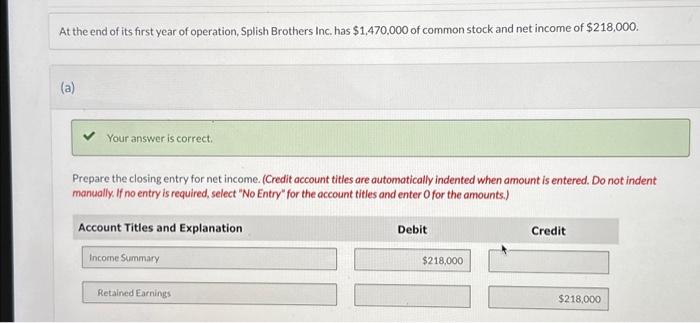

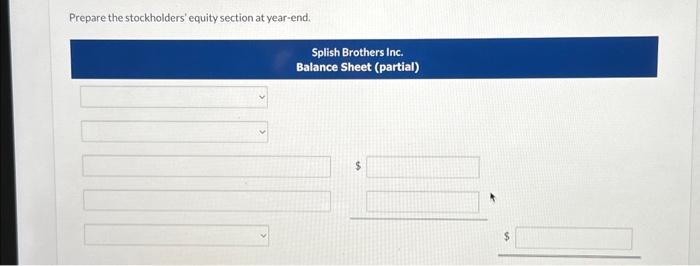

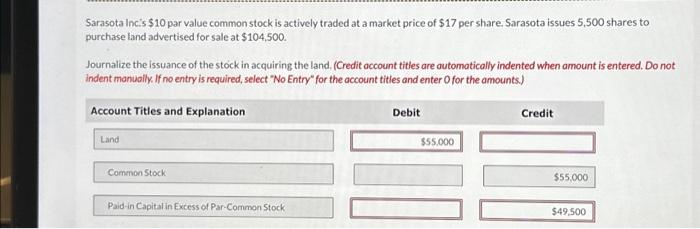

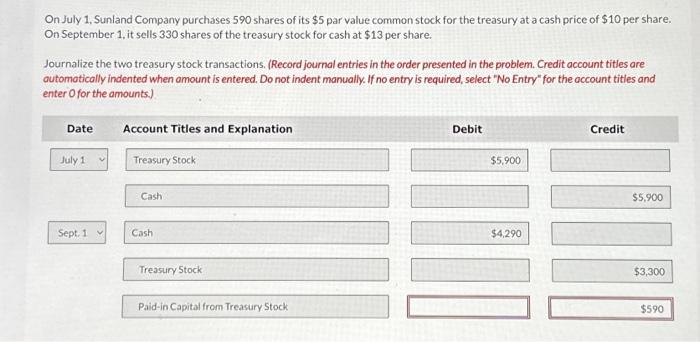

At the end of its first year of operation, Splish Brothers Inc. has $1,470,000 of common stock and net income of $218,000. (a) Prepare the closing entry for net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Prepare the stockholders' equity section at year-end. Sarasota Incis $10 par value common stock is actively traded at a market price of $17 per share. Sarasota issues 5,500 shares to purchase land advertised for sale at $104,500. Journalize the issuance of the stock in acquiring the land. (Credit occount titles are automatically indented when amount is entered. Do not indent monually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) On July 1, Sunland Company purchases 590 shares of its $5 par value common stock for the treasury at a cash price of $10 per share. On September 1, it sells 330 shares of the treasury stock for cash at $13 per share. Journalize the two treasury stock transactions. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts