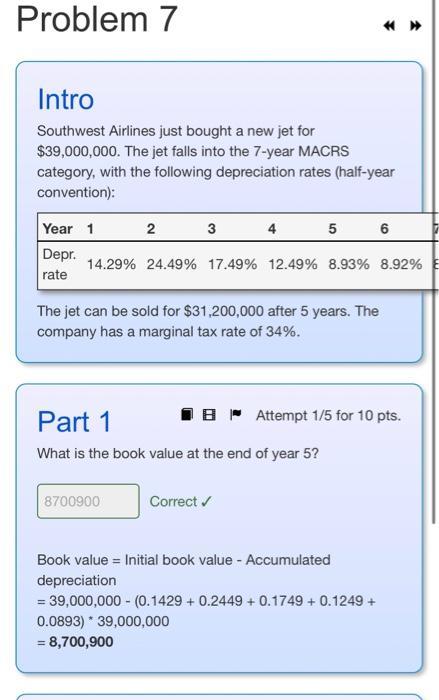

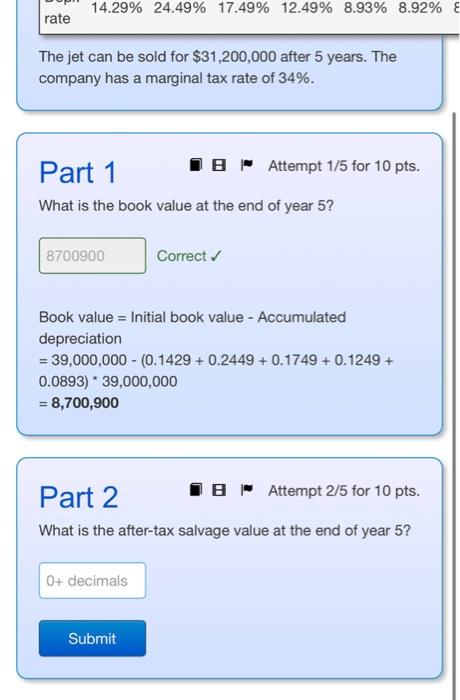

Question: Do part 2 Book value = Initial book value Accumulated depreciation =39,000,000(0.1429+0.2449+0.1749+0.1249+0.0893)39,000,000=8,700,900 The jet can be sold for $31,200,000 after 5 years. The company has

Book value = Initial book value Accumulated depreciation =39,000,000(0.1429+0.2449+0.1749+0.1249+0.0893)39,000,000=8,700,900 The jet can be sold for $31,200,000 after 5 years. The company has a marginal tax rate of 34%. Part 1 Attempt 1/5 for 10 pts. What is the book value at the end of year 5 ? Correct Book value = Initial book value Accumulated depreciation =39,000,000(0.1429+0.2449+0.1749+0.1249+0.0893)39,000,000=8,700,900 Part 2 1 Attempt 2/5 for 10 pts. What is the after-tax salvage value at the end of year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts