Question: do part a , b and c thank you the question is here kindly answer part a FOR Blue Spruce Company ended its fiscal year

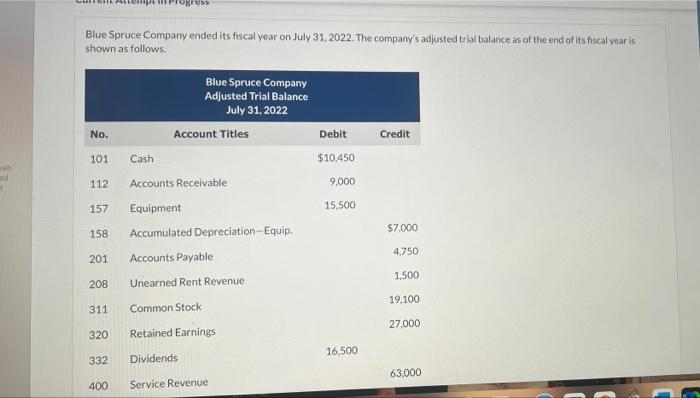

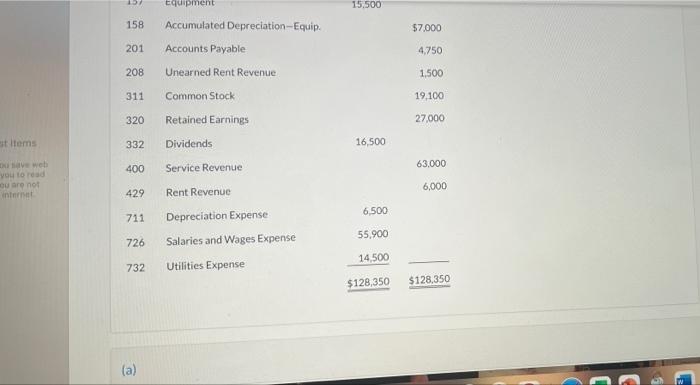

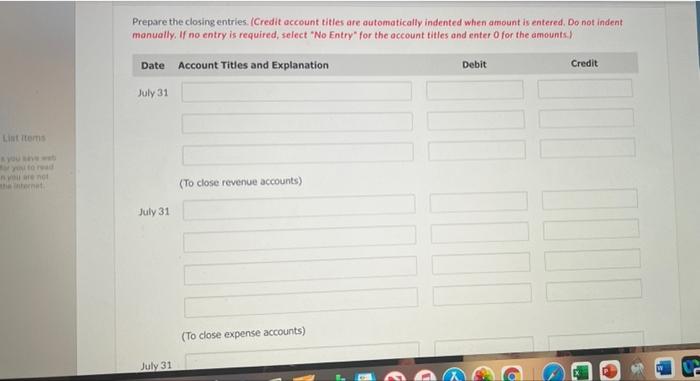

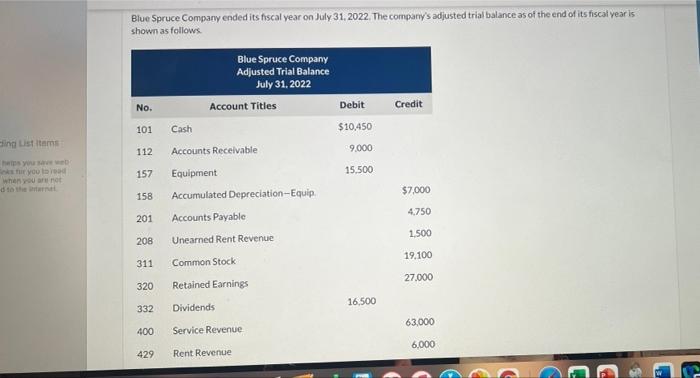

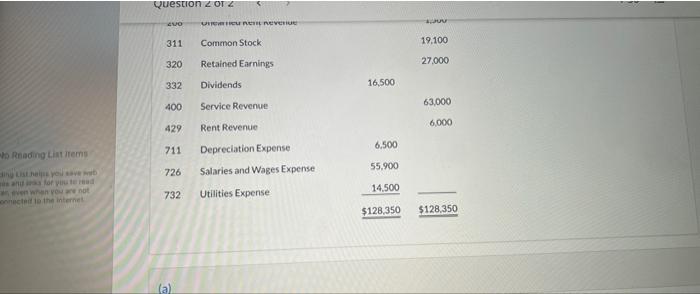

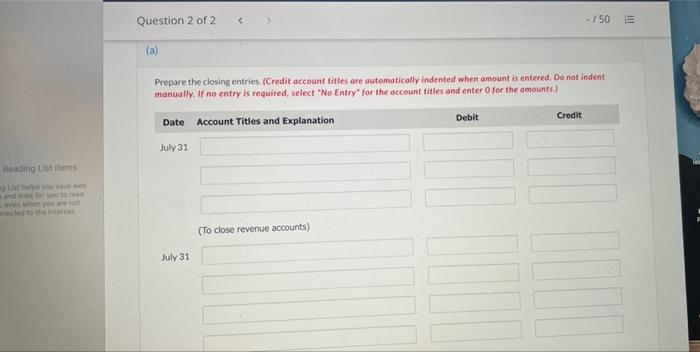

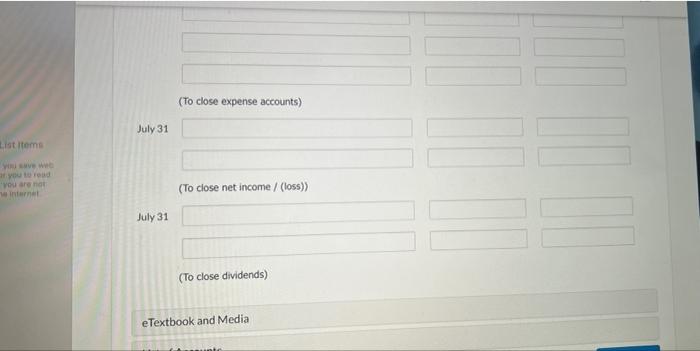

FOR Blue Spruce Company ended its fiscal year on July 31, 2022. The company's adjusted trial balance as of the end of its fiscal year is shown as follows. Blue Spruce Company Adjusted Trial Balance July 31, 2022 Account Titles No. Debit Credit 101 Cash $10,450 ad 1 112 9,000 157 15,500 $7.000 158 4.750 201 Accounts Receivable Equipment Accumulated Depreciation-Equip, Accounts Payable Unearned Rent Revenue Common Stock Retained Earnings 1,500 208 19.100 311 27,000 320 332 Dividends 16,500 63,000 400 Service Revenue 13 15.500 Equipment Accumulated Depreciation-Equip. 158 $7.000 201 Accounts Payable 4.750 208 Unearned Rent Revenue 1,500 311 Common Stock 19.100 320 Retained Earnings 27,000 stems 332 Dividends 16,500 400 Service Revenue 63.000 web you to read ou are not int 6,000 429 Rent Revenue 6.500 711 55.900 726 Depreciation Expense Salaries and Wages Expense Utilities Expense 14 500 732 $128,350 $128.350 (a) Prepare the closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit July 31 Litom or no (To close revenue accounts) July 31 (To close expense accounts) July 31 Blue Spruce Company ended its fiscal year on July 31, 2022. The company's adjusted trial balance as of the end of its fiscal year is shown as follows Blue Spruce Company Adjusted Trial Balance July 31, 2022 No. Account Titles Debit Credit 101 Cash $10,450 ing List Items 112 Accounts Receivable 9.000 yoon when you 157 Equipment 15.500 158 Accumulated Depreciation-Equip $7.000 4.750 201 Accounts Payable 1.500 208 Unearned Rent Revenue 19.100 311 Common Stock 27.000 320 Retained Earnings 332 Dividends 16.500 63,000 400 Service Revenue 6.000 429 Rent Revenue > Question 2 OTZ vo UNTURI REVER 311 Common Stock 19.100 320 27.000 Retained Earnings Dividends 332 16,500 400 Service Revenue 63.000 6,000 429 Rent Revenue 711 6.500 Reading Listiem 55.900 726 Depreciation Expense Salaries and Wages Expense Utilities Expense of Von te the internet 14.500 732 $128,350 $128,350 la Question 2 of 2 - / 50 E (a) Prepare the closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Date Credit Debit Account Titles and explanation July 31 Reading List items List you waweb for you to read who you are (To close revenue accounts) July 31 (To close expense accounts) July 31 List Items ve you troud You are not (To close net income / (loss)) July 31 (To close dividends) e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts