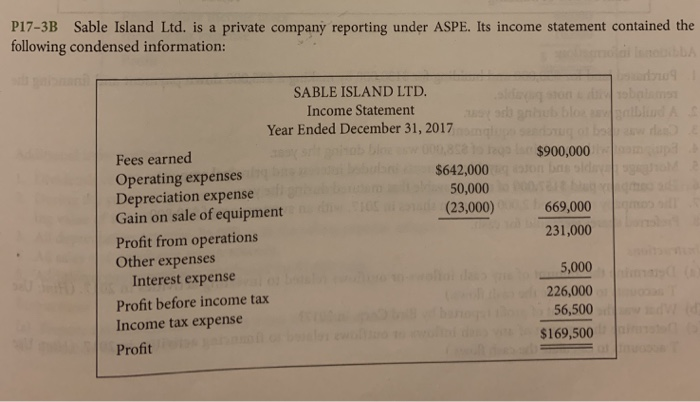

Question: do part a), b) P17-3B Sable Island Ltd. is a private company reporting under ASPE. Its income statement contained the following condensed information: $900,000 amp

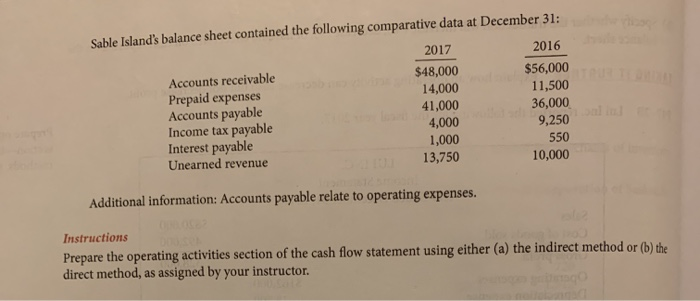

P17-3B Sable Island Ltd. is a private company reporting under ASPE. Its income statement contained the following condensed information: $900,000 amp SABLE ISLAND LTD. Income Statement Year Ended December 31, 2017 Fees earned 000 Operating expenses $642,000 Depreciation expense 50,000 Gain on sale of equipment (23,000) Profit from operations Other expenses Interest expense Profit before income tax Income tax expense Profit 669,000 231,000 5,000 226,000 56,500 $169,500 Sable Island's balance sheet contained the following comparative data at December 31: Accounts receivable Prepaid expenses Accounts payable Income tax payable Interest payable Unearned revenue 2017 $48,000 14,000 41,000 4,000 1,000 13,750 2016 $56,000 11,500 36,000 9,250 550 10,000 Additional information: Accounts payable relate to operating expenses. Instructions Prepare the operating activities section of the cash flow statement using either (a) the indirect method or (b) the direct method, as assigned by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts